[Serenity Premium] Bitcoin on EVMs and its Yield [2nd Review Sept 2024]

This article is for people who hold BTC and wish to have some yield. We have earlier looked into BTC layer2 and ordinals markets (see article here), and honestly, we think the market is somewhat chaotic. So this article focuses only on BTC tokenised on Ethereum and EVMs, and what kind of yield they can generate.

Tokenised BTC

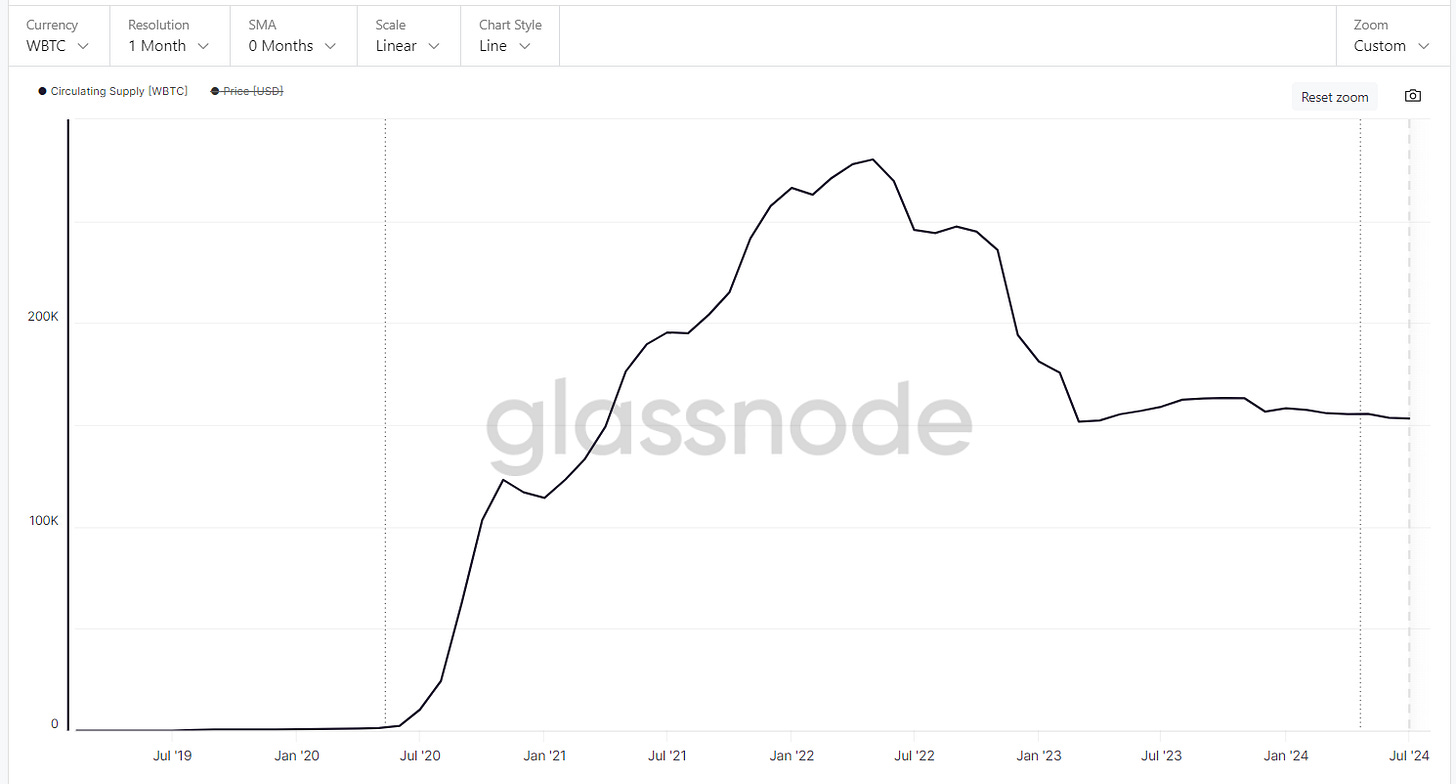

There are only a few tokenised BTC on Ethereum, with the largest being Wrapped BTC (WBTC). WBTC is operated by Bitgo, a centralised custodian company backed by Goldman Sachs. Bitgo holds 152,942 BTC and mints WBTC on Ethereum on a 1:1 basis, since January 2019. Despite this is less than 1% of the Bitcoin circulation, WBTC by far is the leader of tokenised BTC on Ethereum.

Last month, Bitgo announced that it plans to change the legal custody over its WBTC product into a “multi-jurisdictional and multi-institutional” joint venture with BiT Global as part of a strategic partnership with Justin Sun and the Tron ecosystem.

This triggered concerns from industry participants, such as MakerDAO. The DeFi protocol immediately launched a governance discussion on Monday aimed at removing WBTC collateralization from its DAI stablecoin. About 3% ($155 million) of DAI’s collateral backing is made up of WBTC, according to Makerburn.

This also spurred the growth of other tokenised BTC and maybe accelerated new launches, such as Coinbase's cbBTC. Tokenised BTC has to be done is a custodian manner, and reputation plays an important role here. Below is the list of some key players in the tokenised BTC battleground.

Threshold tBTC

Threshold (company name Thesis) is the designer of a decentralised BTC tokenisation system. It was launched in May 2020, but was relatively small compared to WBTC. As of today, it holds 3,464 BTC, backing its tBTC on Ethereum. Threshold is essentially a bridging system, where validators work to maybe bridging BTC to Ethereum network permissionless. An article explaining the difference between WBTC and tBTC is here.

Coinbase cbBTC

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.