[Serenity Premium] Dai, EDSR and MakerDao Valuation [Initial Review Aug 2023]

This article explains what's going on with DAI: the 8% EDSR, its massive real world assets backing, and MakerDao's valuation.

The EDSR

The Overview

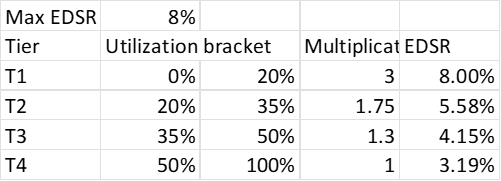

Enhanced Dai Saving Rate (EDSR) is a temporary incentive to encourage the growth of Dai. It was proposed in mid July in the governance forum and soon voted pass in via an executive proposal on 4 Aug.

Dai's Saving Rate (DSR) has been 3.2% before the proposal and this is a hike, intended to encourage users mint more Dai. The proposal has also clearly spelled out that this rate is not sustainable, as the average cost of borrowing DAI is about 2% to 3%. So it's been designed that when more Dai is deposited into the DSR vault, the EDSR rate will decrease.

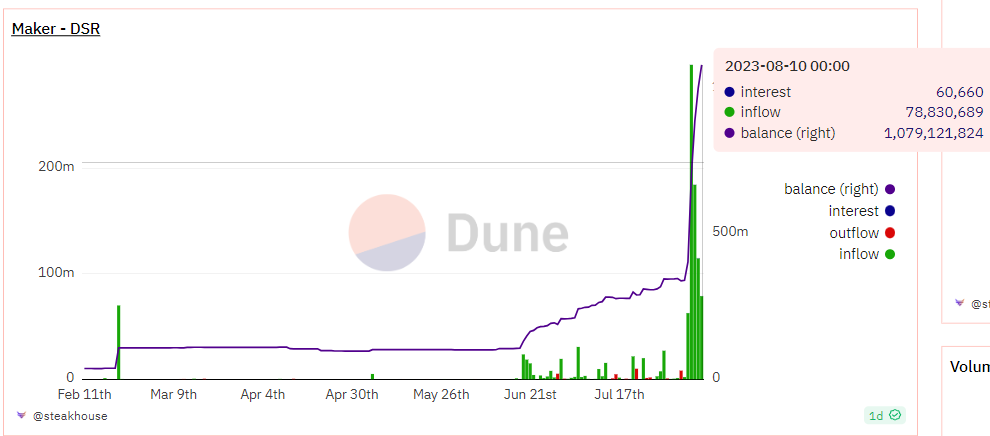

In less than 3 days after the 8% EDSR being enacted, 1.2 billion Dai has been deposited into the DSR vault. This is a risk-free investment in many people's perspective (including us). According to @runekek, the CEO and founder of MakerDao, the surge was due mainly to " the massive scale of ETH and Staked ETH whales harvesting yield from the EDSR through borrow arbing". We decipher that in Rune's opinion, this is more of "hot money" and not sticky to MakerDao. Therefore, Rune proposes to revise the EDSR plan with a forum post on 8 Aug, which essentially revise the above tiering system to 5% yield when the utilisation is within 0% to 35%.

In other words, given the current amount of DAI minted (Dai in circulation 4.0b and DSR sdai 1.2b), if there's less than 1.8b DAI in the DSR, then the 5% yield will be there for the long-term. This is reasonable against the average Dai borrowing cost of 2% to 3%.

We also note that any revision of the EDSR rate has to be mannually done via another executive proposal, whether it's based on the original or revised plan.

The Impact

The 8% rate caused an expected surge in Dai deposits immediately, as this is effectively risk-free in the stablecoin framework. (Source: https://dune.com/SebVentures/maker---accounting_1)

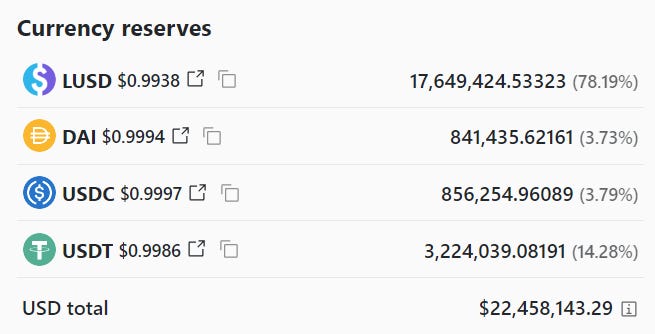

Also, the demand for Dai has drained a few Curve pools of competitor stablecoins, such as LUSD and alUSD. Some users, instead of depositing ETH to mint Dai, turn to Liquity to deposit ETH to mint LUSD and sell into Dai. Liquity does not charge an interest rate on users, so it's cheaper compared to minting Dai via Makerdao. This caused LUSD to depeg slightly to 0.993, which rarely happened in the past.

Dai's Backing

Overview

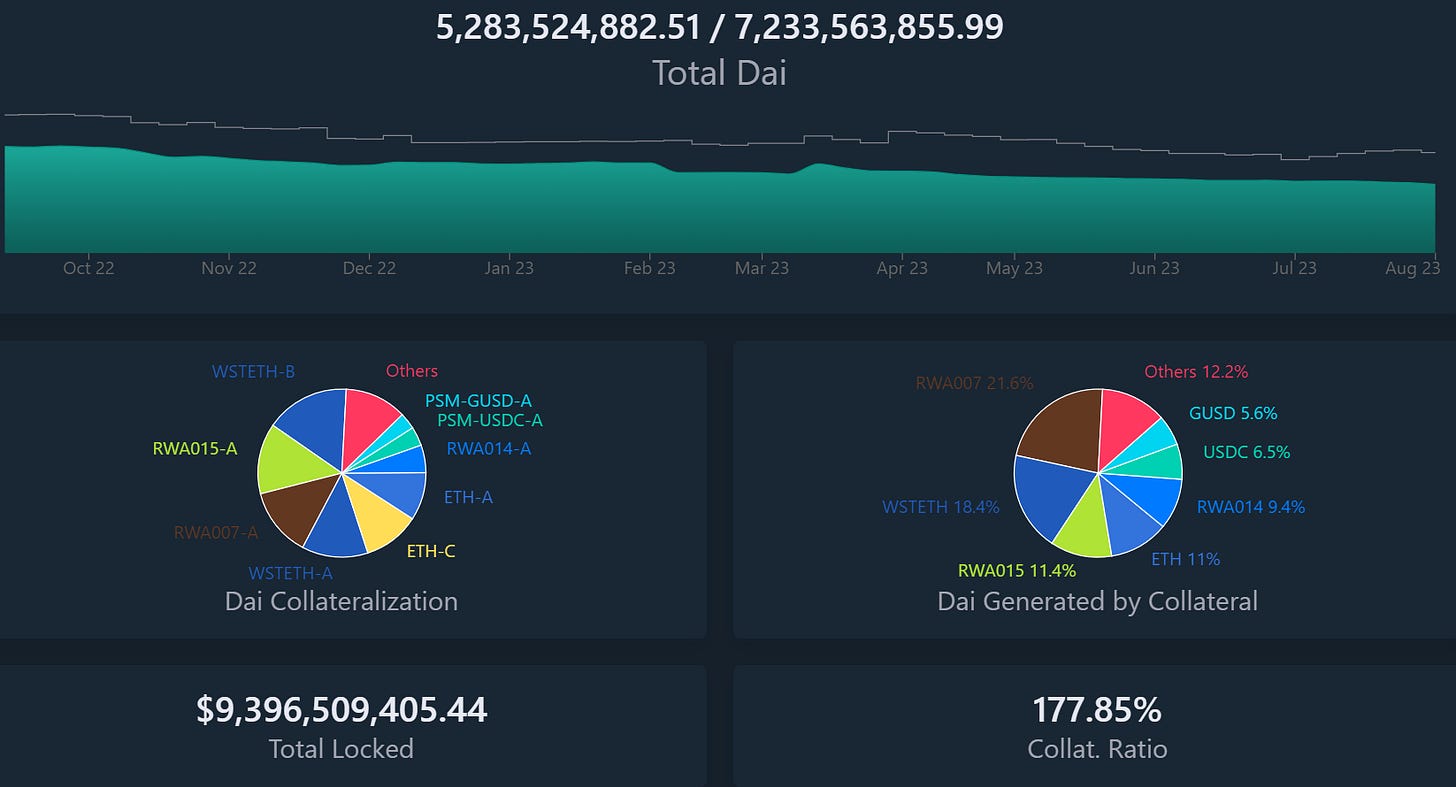

Although Dai started as a purely cryptocurrency overcollateralised stablecoins, it has turned into a mix of real world assets (RWA) and crypto today. According to https://daistats.com/#/overview, now 2.5b Dai, or approximately 47% of all Dai minted, are backed by real world assets now.

Some largest vaults of Dai's RWA are:

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.