[Serenity Premium] DOLA Stablecoin and Inverse Finance [Initial Review Mar 2023]

Introduction

We have come across in several DeFi markets a stablecoin DOLA. Usually, a stablecoin pair containing DOLA will give higher yield, suggesting some additional risks involved in DOLA. For instance, several stable pools involving DOLA stablecoin have over 15% APR in Velodrome, an innovative DEX based on the Optimism chain, and an improved fork of Solidly.

For readers who may not be familiar with the Velodrome protocol, we have previously published an article outlining its features and functionality. In this article, our attention will be directed towards Inverse Finance's lending market products and its stablecoin, DOLA.

DOLA and Inverse Finance

Overview

Inverse Finance is a decentralized finance protocol specializing in the creation and management of various DeFi tools and products. Notable among these products are a lending market and a stablecoin known as 'DOLA.' Unfortunately, Inverse Finance faced a setback when its Frontier lending market had to be suspended due to two security exploits last year. Consequently, Inverse Finance has prioritized reducing its bad debt. Meanwhile, the team has been developing their latest offering, FiRM (Fixed-Rate Money Market), a refined version of Frontier boasting enhanced functionalities, improved security measures, and the added ability to facilitate fixed-rate borrowing of DOLA.

DOLA functions as a hybrid between algorithmic and collateralized stablecoins, seamlessly integrating with Inverse's other products such as Frontier and FiRM. It gains partial collateralization from deposits in its lending markets, while Inverse Finance issues the remaining portion to maintain DOLA's stability across various liquidity pools. Following the suspension of the Frontier lending market, all minting and burning processes for DOLA have been managed by Inverse's Fed Chair multisig.

Inverse’s Fed contracts

Per Inverse Finance's documentation, the Inverse Finance Fed contracts enable the direct minting of DOLA into the supply side of lending markets, the DOLA-3CRV Curve pool, or other liquidity pools authorized by the Fed in response to market demand for DOLA. This adaptable and responsive strategy ensures DOLA's supply closely aligns with market requirements, maximizing its utility and value within the DeFi ecosystem.

In simpler terms, the Inverse protocol's DOLA stablecoin leverages Fed contracts to manage its minting and burning processes. These contracts fall under the control of a multi-signature group known as the Fed Chair. The Fed contracts execute three primary functions to maintain control over DOLA's supply: expansion, contraction, and take profit. The expansion function mints DOLA directly into the lending pool's supply side, subsequently reducing the borrowing APY. In contrast, the contraction function burns DOLA from the lending pool's supply side, resulting in an increased borrowing APY. Finally, the take profit function transfers all borrower-generated profits to the Inverse treasury, causing a slight increase in the borrow APY%.[1]

Moreover, only the account holder with the "Fed Chair" role can operate these functions. The current Fed Chair for all DOLA lending pools is a 2-of-6 multi-signature wallet managed by Inverse team members.

The protocol's website presents a comprehensive overview of all active and past Feds. As of the time of writing, Velodrome Fed accounts for over 50% of the total value locked (TVL), followed by Frontier and FiRM, which constitute 34.47% and 4.29% of the TVL, respectively.[2]

DOLA’s minting process and peg management

Currently, DOLA's issuance employs various methods, deviating from its original model of collateral-based issuance through Frontier, which has been temporarily paused due to past exploits. Instead, DOLA now enters circulation through the following channels:

Borrowing DOLA – Individuals can borrow DOLA via the FiRM protocol by using WETH, gOHM, stETH, and CRV as collateral[3] or through the supply side of partnered money markets, facilitated by Fed contracts.

Liquidity Pools - Another way to acquire DOLA is through liquidity pools on Velodrome or Curve. Velodrome primarily manages DOLA's circulation by injecting or withdrawing it from the factory pool: sAMM-USDC/DOLA. Holding a total of 20.19 million DOLA, this pool contains the largest DOLA amount[4].

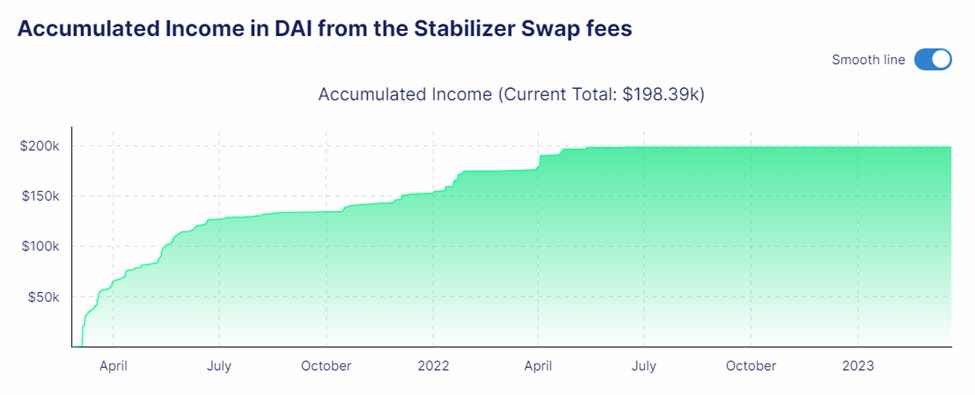

The Stabilizer - Finally, DOLA can be minted with $DAI using the Stabilizer contract, which applies a 0.4% fee on each transaction to generate revenue for the DAO. Although no profits have been recorded in the past three months, the Stabilizer can act as a safeguard during a positive depeg (when DOLA is valued above $1).[5]

To manage its peg, Inverse ensures that DOLA maintains a fixed exchange rate of 1:1 with the US Dollar, utilizing three key components to manage its supply[6]:

Fed Contracts - These contracts manage the minting or recalling of DOLA tokens for Inverse's internal products like Frontier and FiRM, as well as external protocols and partners such as Curve, Balancer, Yearn, Rari, Aura, and Velodrome.

Liquidity Pools - These pools exist on Curve (DOLA/FRAXBP), Velodrome (sAMM-USDC/DOLA), and DOLA/INV, facilitating DOLA's exchange with other assets.

Stabilizer – This component aims to minimize price fluctuations and maintain DOLA's peg to the US Dollar. If the DOLA peg deviates from the intended $1.00 USD value, the Stabilizer executes arbitrage operations to ensure a stable exchange rate of 1 DAI = 0.996 DOLA or 1 DOLA = 0.996 DAI, provided there is sufficient liquidity within the Stabilizer. This mechanism operates similarly to the Peg-Stability Modules (PSMs) used by MakerDAO. However, the DAI pool, crucial to the Stabilizer's function, currently has a liquidity of only $369.66, rendering it an ineffective peg mechanism for DOLA at present.[7]

The Hack and Its Impact

Frontier, a now-deprecated lending market, faced significant challenges due to two exploitation incidents in April and June 2022, which resulted in substantial bad debt.

During the first incident, a hacker executed a sophisticated and capital-intensive market manipulation, withdrawing over $15.6 million in user funds. The attacker manipulated the price of $INV, Inverse Finance's native token, inflating its value as collateral and enabling the borrowing of millions from Anchor's pools. According to rekt.news, the hacker's tactics were highly professional, revealing an unexpected attack vector rather than a glaring vulnerability[8]. Ultimately, the attacker made off with 1,588 ETH, 94 WBTC, 39 YFI, and 3,999,669 DOLA, valued at around $15.6 million at the time.

Two months later, a second exploit involved a flash loan attack, resulting in a total loss of $5.8 million, with the attacker absconding with $1.2 million. DeFi Safety deemed the second attack "foreseeable," emphasizing the importance of continuous security audits and updates to protect DeFi protocols and users' funds.

Following the two attacks, a significant portion of Anchor users were left with IOU tokens, also known as anTokens. The attacks resulted in the loss of over 24% of the total value locked (TVL) at the time, resulting in a substantial amount of bad debt for Inverse Finance. As an immediate response, the Anchor protocol was paused, and the Inverse Finance team began working on potential solutions to repay the bad debt and reimburse affected users. According to RiskDAO’s data, Inverse Finance still currently has over $15.97 million in bad debt.[9]

Since June 2022, all lending activities on the Frontier platform have been permanently halted by the Inverse Finance DAO due to the bad debt accumulated from the oracle price manipulation incidents mentioned earlier. In response, the DAO has implemented weekly repayments to reduce the bad debt and launched two new products in September 2022, aimed at expediting the return of funds to affected users and overall debt repayment for the DAO.

The first product, the Debt Repayer, allows IOU token holders to withdraw their original collateral. Inverse Finance periodically fills the contract with WBTC, YFI, and ETH by redirecting a portion of their income to the Debt Repayer. Users can then withdraw the accumulated funds at their discretion.

The second product, the Debt Converter, enables users to convert their IOU tokens, such as anETH, anWBTC, or anYFI, into DOLA-denominated IOU tokens. The DAO regularly funds the Debt Converter with DOLA, which can be withdrawn by anToken holders.

These new products provide Inverse Finance ecosystem users with additional options to expedite the return of their funds and alleviate the impact of the bad debt resulting from the previous attacks on the system.

DOLA and Its Collaterals Now

There are a total of 60.0 million DOLA according to Etherscan. A significant portion of the DOLA supply, totaling 59.8 million, is held by Inverse Finance. Inverse manages the supply of DOLA through its Fed contracts, which facilitate the minting and recalling of DOLA for its products (Frontier and FiRM) and external protocols/partners such as Curve, Balancer, Yearn, Rari, Aura, and Velodrome.

We divide the 59.82m DOLA into two categories:

40.37m DOLA in DeFi protocols that are softly backed by protocol owned liquidity

19.45m DOLA in Frontier and these are not explicitly explained how they are backed

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.