GMX is the leading perpetual trading platform on Arbitrum (and Avalanche as well), one of the best innovative DEXes recently. GMX's platform features a unique portfolio unit represented by the GLP token, which serves as the counter-party to traders holding long or short positions on GMX. The GMX vault has been specifically designed to include a diversified portfolio comprising of 50% stablecoins and 50% mainstream tokens like Bitcoin (BTC) and Ethereum (ETH).

Since its launch, GMX has been garnering attention and quite a number of derivatives and forks are built based on GMX protocol, utilising GLP or improving the protocol in some aspects. This article reviews the GMX derivatives, mainly on Arbitrum, including:

Abracadabra and Beefy GLP Auto-compounder

Plutus DAO and Yield Yak Incentivised Farming

Mugen Finance Discounted GLP Portfolio

GMD Protocol Impermanent Loss Protected GLP

Jones DAO Leveraged GLP Vault

Rage Trade GLP Trenching

Tender Fi and Sentiment GLP as Collateral

Note: Different protocols use different time horizons and measurements for calculating the yield of GLP, e.g. 7 days or 30 days weighted average, APR vs APY, etc. Please do not be confused by the numbers stated on the protocol websites, but rather refer to the yield and fee descriptions in the documentations for a more precise calculation of the returns.

Abracadabra and Beefy GLP Auto-compounder

Abracadabra, the issuer of Magic Internet Money stablecoin, offers a simple GLP staking service that auto-compounds the fees in ETH received by GLP holders into GLP units. The service charges a 1% fee on the yield. This straightforward service is built on top of GMX and offers an easy way for users to stake their GLP tokens.

Like Abracadabra, other aggregators also offer auto-compounding vaults for GLP. For example, Beefy provides such vaults for GLP on both Arbitrum and Avalanche. While there is no fee for using the Beefy GLP vault on Arbitrum, there is a 0.1% withdrawal fee for the Beefy GLP Avalanche vault.

Plutus DAO and Yield Yak Incentivised Farming

Although it is a less popular protocol, Plutus DAO (https://plutusdao.io/vaults) was one of the first protocols to offer a GLP compounding service. While the service charges a 2% withdrawal fee, it also provides rewards in the form of its platform tokens, which serves as an incentive for users.

Yield Yak (https://yieldyak.com/farms) also provides a GLP farming service on the Avalanche chain. Although it charges a performance fee of 10%, Yield Yak compensates depositors with AVAX rewards, making the service more attractive to users.

Mugen Finance Discounted GLP Portfolio

Mugen Finance (https://www.mugenfinance.com/#honeycomb) is an interesting use case of GLP. Mugen Finance is essentially a vault holding approximately $3.3m (or $129.22 per $MGN) worth of GLP. The vault is represented by $MGN token, which has a market capitalisation of only $2.5m (or $95.10 per $MGN), a 25% discount to the intrinsic value of the vault. Although $MGN can be traded on Uniswap, it cannot be directly exchanged for the underlying GLP, resulting in the discount potentially persisting for some time. While the vault's investments are currently solely in GLP, Mugen Finance plans to diversify into other investments in the future.

The above is from the community front-end: https://www.mugeys.com/.

GMD Protocol Impermanent Loss Protected GLP

GMD Protocol (https://app.gmdprotocol.com/gmxvault) has introduced an innovative approach to tackle the issue of impermanent loss associated with GLP. GLP's yield is affected by three factors: 1) trading fee income; 2) trader's profit and loss; and 3) impermanent loss resulting from changes in the prices of the composite tokens. While the first factor is consistently positive and the second factor is unpredictable, the third factor is akin to a Uniswap V2 vault of ETH-USDC and is difficult to hedge perfectly. To address this issue, GMD has established a reserve that absorbs such impermanent losses, which is a unique solution to this problem.

GMD's reserve absorbs impermanent losses, allowing users to deposit stablecoins, BTC, and ETH separately into the vault and earn delta-neutral yields. The platform charges a deposit fee of 0.25% to 0.5% for this service.

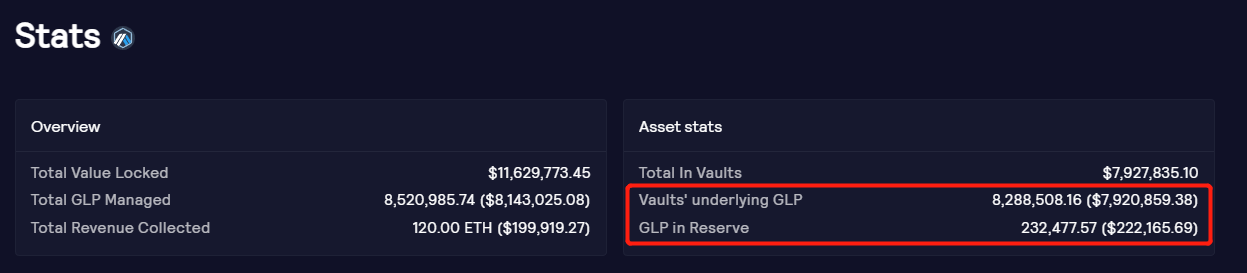

GMD's reserve is made up of GLP purchased using funds raised from selling $GMD tokens during the initial stage. It's designed to be maintained between 5% and 15% of the total value locked (TVL) of the GLP vault in the GMD protocol. You can find more details on the reserve in the documentation. However, at the time of writing, the GMD reserve on Arbitrum was below this ratio, at only about 3%. It's not clear from the documentation how the reserve will increase to compensate for absorbing impermanent losses.

[Update on 27th Feb: following our post, we were contacted by a GMD seed investor, who suggested that the actual reserve was larger than stated above. The deBank link is here: https://debank.com/profile/0x4bf7a0c21660879fdd051f5ee92cd2936779ec57, which had over $1m in assets but also included a substantial portion of $GMD token. We noted the above statement and presented this additional information here for completeness.]

Jones DAO Leveraged GLP Vault

In contrast to GMD's focus on achieving delta neutrality, Jones DAO (https://app.jonesdao.io/vaults) has built a service on top of GMX that allows users to amplify their exposure to GLP. Jones DAO has a leveraged GLP vault and a USDC vault, where GLP vault can borrow funds from to buy more GLP.

The USDC vault distributes 30% to 50% of the total GLP yield, depending on its utilization. More information can be found in the documentation available here. However, it is unclear from the documentation whether gains made by traders could impair the jUSDC vault and result in a loss for the GLP in the jGLP vault.

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.