[Serenity Premium] HyperLiquid [Initial Review Jun 2025]

HyperLiquid started as an on-chain perps trading platform and grew rapidly in scale in the past 12 months. Today it is the largest on-chain perps and competing with CEXes for volume. On top of its perps service, it has also built an infrastructure for EVM, enabling an ecosystem of dAPPs. A strong revenue stream from trading fees is HyperLiquid's main selling point, but it was also criticized for its lack of decentralisation. This article does not go to every detail of what HyperLiquid is, which is widely known; rather, it examines some parameters like trading volume/revenue ratio and takes a look at HyperLiquid's valuation.

The Business of HyperLiquid

From its inception two years ago, HyperLiquid generated $1800 billion in volume. In Jun 2025, its daily volume averaged more than $7 billion.

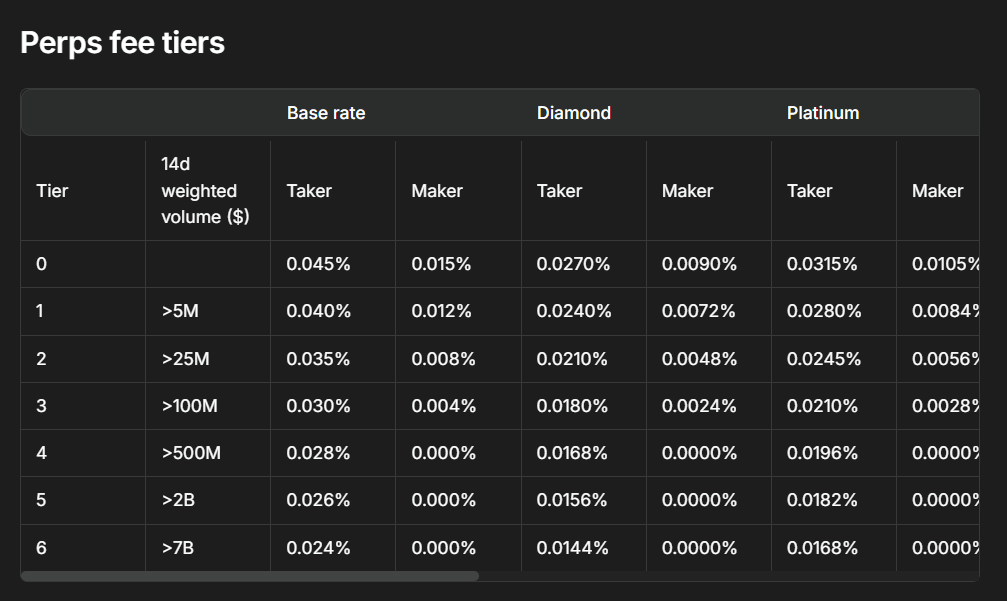

HyperLiquid charges a fee for trading on its perps and spot market. The fee ranges from 0% (marker top tier) to 0.045% (taker base rate) for perps market, which is similar to CEXes like Binance and Bybit. Spot fees are slightly higher, in line with market convention.

According to Blockworks' research, 93% of the fees are used to buy back $HYPE from the spot market, and parked under an address called Assistance Fund. Assistance Fund holds 25.3 million $HYPE now. As the fees charged for each transaction varies, there's no direct link between daily volume and revenue. We used the June data from Blockworks, and derived that for $10,000 dollar of trading volume, Hyper generates

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.