[Serenity Premium] Overnight Finance (Initial Review Jan 2023)

Overnight is a on-chain delta neutral investment fund. It has active portfolios on Optimism, Polygon and BSC. Most of its portfolios are high yield strategies, such as providing liquidity to option platforms or delta neutral liquidity providing. Via investment in its token USD+, investors share the risks and returns of Overnight Finance's portfolios.

The Strategy in this Article

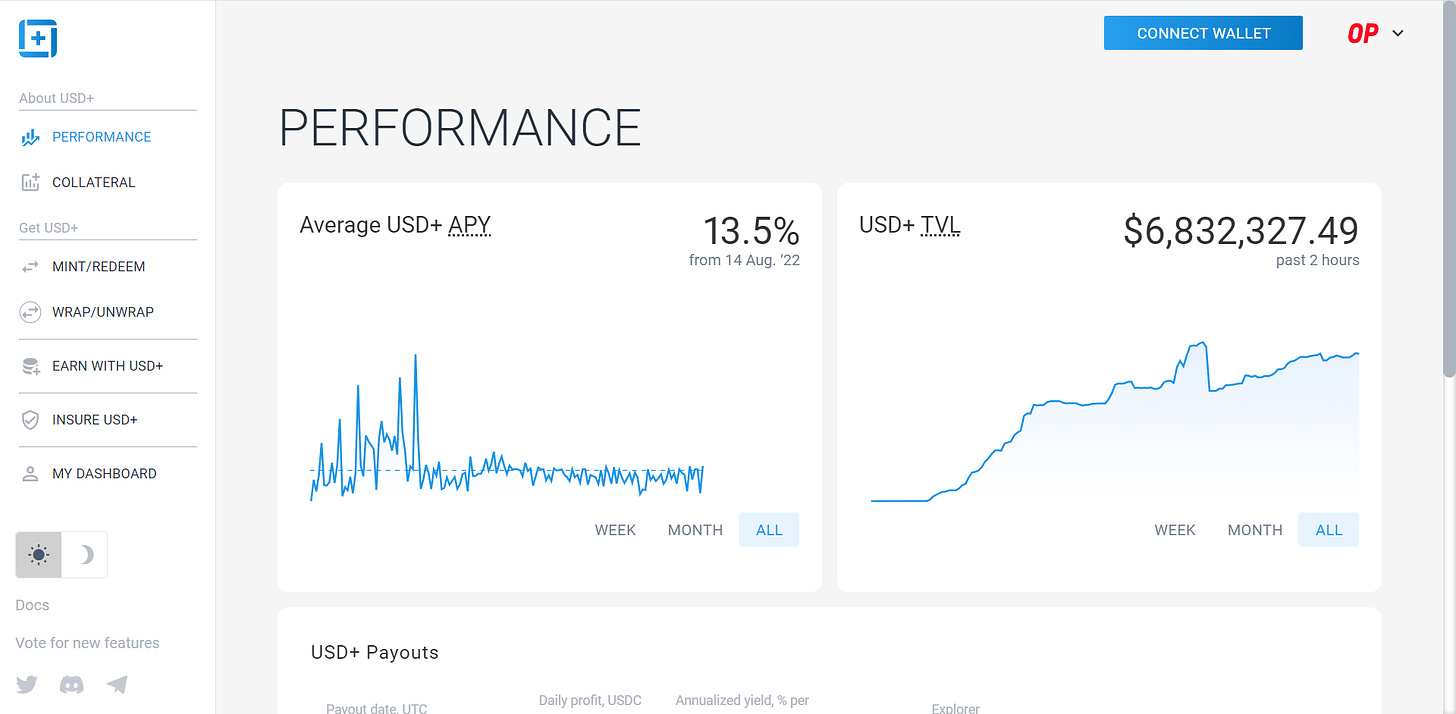

This strategy is simply purchasing USD+ on Optimism. USD+ is the token issued by Overnight to represent units of its portfolios. Each chain, where Overnight has a portfolio, has a version of USD+; they are not fungible. USD+ is a rebased token, and it can always be minted and redeemed at 1 USDC. Yields from its portfolio investments are adjusted daily to holder's wallets, via rebase.

Current yield: 13.5% (19 Jan 2023)

Our risk assessment: High

Our yield projection based on this week's Benchmark Yield: 15.6%

The Concept and How the Protocol Works

Overview

Overnight Finance is an on-chain fund manager. It collects USDC from investors, and invests into different strategies.

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.