[Serenity Premium] Pendle Finance's Business Model [2nd Review Jun 2023]

Pendle Finance is an innovative yield trading market on Ethereum and Arbitrum. We covered the basic mechanism of Pendle markets in Dec last year. In this article, we will look into the yield generation model and revenue distribution of Pendle Finance.

Types of Yield Generated by Pendle

Pendle Finance provides the yield trading of some yield-bearing tokens, such as GLP. A market in Pendle Finance is the trading pair of the yield-bearing token's the principal portion (PT), and its normal version (wrapped by Pendle, called SY). For instance, the Pendle market for GLP comprises of the principal portion of GLP (PT GLP) and normal GLP (SY GLP). To cap from our earlier article, PT GLP is obtained by synthetically separating a normal GLP token into a yield receiving portion (YT GLP) and the principal portion (PT GLP).

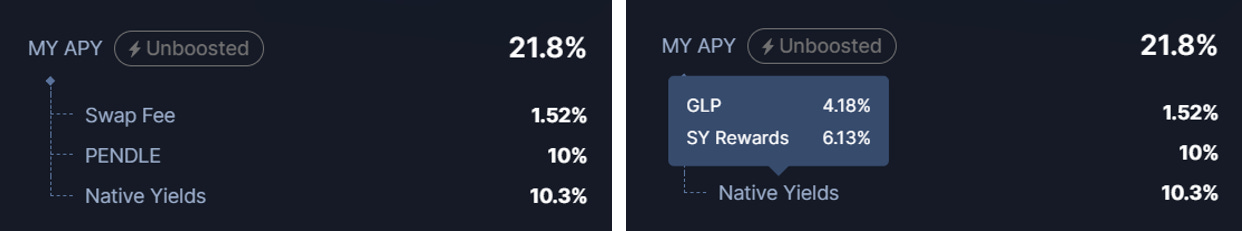

If you are a LP into this market, you will receive a few types of yield, including:

Swap fee from this market (swapping PT and SY)

PENDLE incentives

Yields from GLP's fee (paid in ETH by GMX), shown as SY Rewards below

PT GLP's fixed yield, shown as GLP below

The first two are easy to understand, some explanation is required for the last two:

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.