[Serenity Premium] Reconciling Angle USDA's Balance Sheet [Initial Review Jun 2024

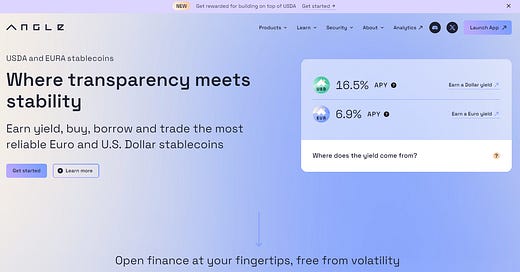

Angle Protocol is the issuer of one of the largest EURO stablecoins agEUR (lately changed name to EURA). Early this year, Angle decided to launch a USD denominated stablecoin USDA. USDA is collateralised by PSM (transmuter in Angle's definition) and Protocol Own Liquidity mechanism, which are common for stablecoins nowadays. The analytics page of Angle's USDA is somehow confusing - it seems to be mixing up assets and liabilities, despite there are clear definitions in its blog. This article seeks to reconcile Angle USDA's balance sheet and assess its collateralisation status.

Angle's Stablecoin Mechanism in Summary

Angle's USDA is stablilised by a PSM, which it terms Transmuter. Beyond Transmuter, Angle mints uncollateralised USDA, which is Protocol owned liquidity and will only be used for the purpose of a) Uniswap liquidity of USDA-EURA; and b) lending on Morpho Blue via Gaunlet vaults.

Transmuter

The Transmuter of Angle's USDA is simply a PSM, where users can mint or burn stablecoins for USDA. A slight twist is that in the event of a depeg, users can also redeem the underlying assets proportionally. The detailed documentation about Transmuter is here and we do not elaborate in this article.

As of 3 June, Angle USDA Transmuter has $10.7m assets, in line with its set-up AIP.

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.