[Serenity Premium] RWA Stablecoin Series: $rUSD by Reservoir [Initial Review Jan 2025]

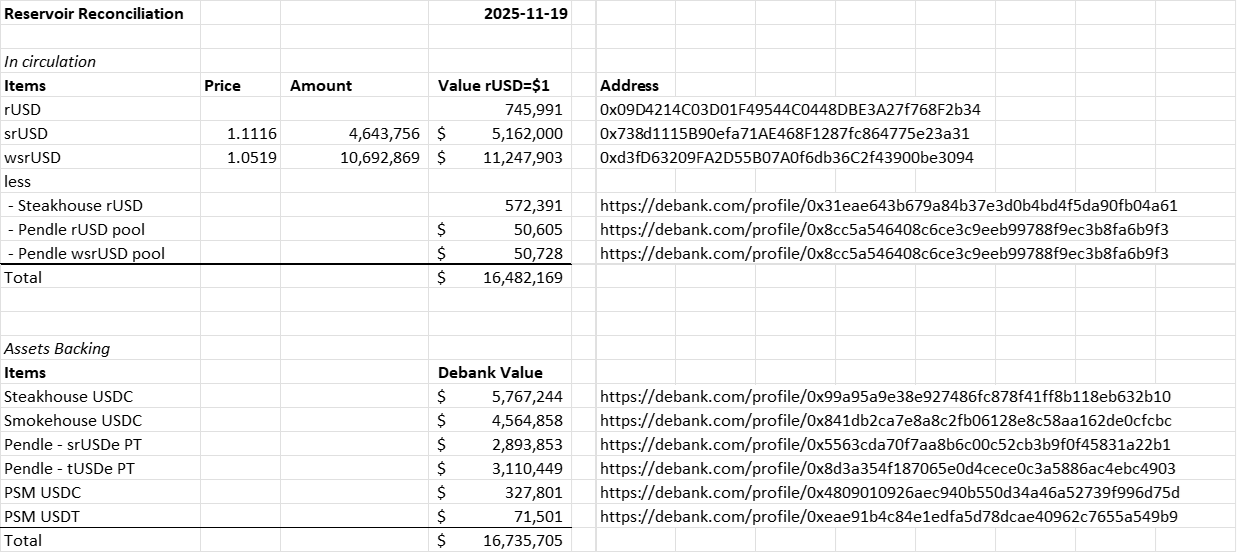

[Updated on 19 Nov 2025]

As @reservoir_xyz unwound its Bera Chain positions, what’s left in the reserve for $rUSD is ok. Here it is:

We deduct $rUSD held in the reserve from the total circulation, which is a typical accounting treatment for treasury shares (companies holding its own shares).

The remaining backing assets are in Morpho lending and Pendle $USDe derivatives. In Morpho Smokehouse, there’s still exposure to $rUSD, but it’s immaterial.

Recursive minting (which leads to a project holdings its own stablecoins) is a way to leverage and does not generate real yield. We are not supportive of it, but we maintain that this can be accounted for as well. So given that a protocol maintains transparency (and ideally a justification for recursive minting other than inflating TVL), we are not against it neither.

[Article on Jan 2025 below]

A few weeks ago we covered $M by M^0 Foundation, the first article of our RWA stablecoin series. This article continues this series on $rUSD by Reservoir. Reservoir is a project by FortunaFi, a tokenisation platform, after its $9.8m fund raising. Fortunafi was founded in 2020 and initially operated as one of the first issuers on the tokenization platform Centrifuge. This article explains the mechanism of Reservoir and also tally its numbers of the rUSD circulation.

The Basics of $rUSD

The underlying assets of $rUSD are a mix of RWA assets like T-bills (via FortunaFi's tokenised products) and on-chain stablecoin investments, like investments into Morpho vaults. It's worth note that everything held in the portfolio by Reservoir is on-chain.

RWA assets: mostly ifBill and ifHV1, which are Fortunafi Tokenized Short-Term U.S. Bonds (International), and Hilbert V1 Fund, tokenised also by FortunaFi. Hibert V1 Fund is not T-bills, but a market-neutral, long-short strategy aims to generate pure trading alpha uncorrelated to other markets. In 2023, it achieved a net return of +8.7%. Hilbert Group is listed on the Nasdaq First North in Sweden, with $300 million in assets under management.

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.