[Serenity Premium] RWA Stablecoin Series: Falcon USDf [Initial Review May 2025]

Recently, we have seen a lot of competitors of USDe, inspired by the vast success of Ethena. Falcon Finance, which is DWF Labs' own business venture, is the latest in this space. Since its launch at the end of April, it has already amassed $260m capital. This article take a quick look at Falcon Finance and its USDf.

Business Model and USDf Functionality

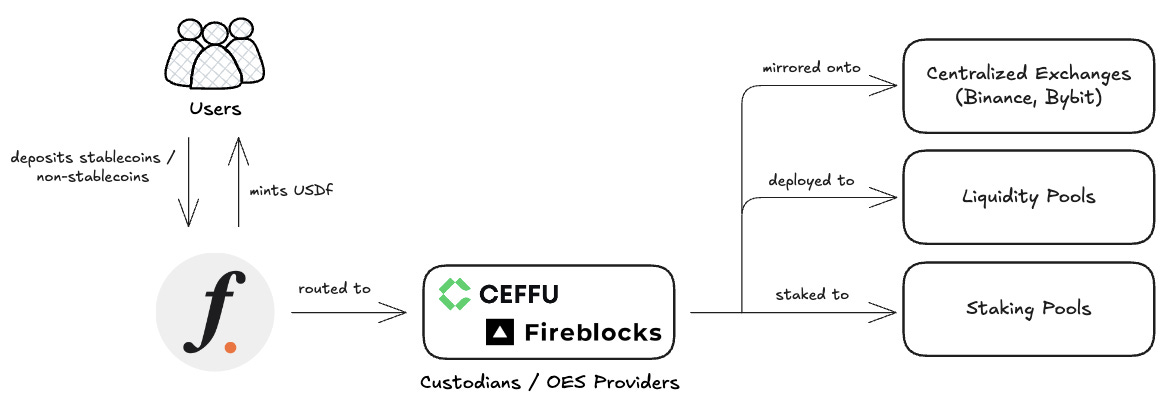

Falcon Finance is an overcollateralized synthetic dollar protocol. Users deposit crypto collateral (stablecoins or other tokens) to mint USDf. The protocol offers a dual-token model: USDf (a 1:1 synthetic USD) and sUSDf (a yield-bearing token). Users can stake USDf to receive sUSDf, which passively accrues yield. Yields are generated via institutional-style trading strategies – e.g. delta-neutral basis and funding-rate arbitrage, cross-exchange arbitrage, liquidity provision and altcoin staking.

According to Falcon’s whitepaper, this approach “broadens the scope” of traditional stablecoin yield by integrating positive and negative funding-rate arbitrage, basis spreads, and institutional-grade strategies, etc. Based on the description, Falcon offers a wider spectrum of stablecoin investment opportunities than Ethena.

Variations and Innovation Compared to Ethena

Other than offering more venues of investments, Falcon has made some slight changes to the stablecoin management system.

Redemption

Users of Falcon need to be KYCed if you wish to mint it directly. Alternatively, you can buy USDf on Curve though the price might not always be $1. Secondly, Falcon creates a sub-account for all KYCed users, where users manage the tokens in the sub-account first. Users need to deposit collaterals like USDC into the sub-account to mint, and when they exit, they redeem USDf into the sub-account as well and withdraw from there. There's a 7-day withdrawal cool-down period. On the other hand, staking USDf and unstaking are real-time (where Ethena has a 7-day unstaking period but no cool-down period on redemption).

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.