[Serenity Premium] RWA Stablecoin Series: OpenEden USDO [Initial Review Apr 2025]

Introduction: Real-World Yields on Chain

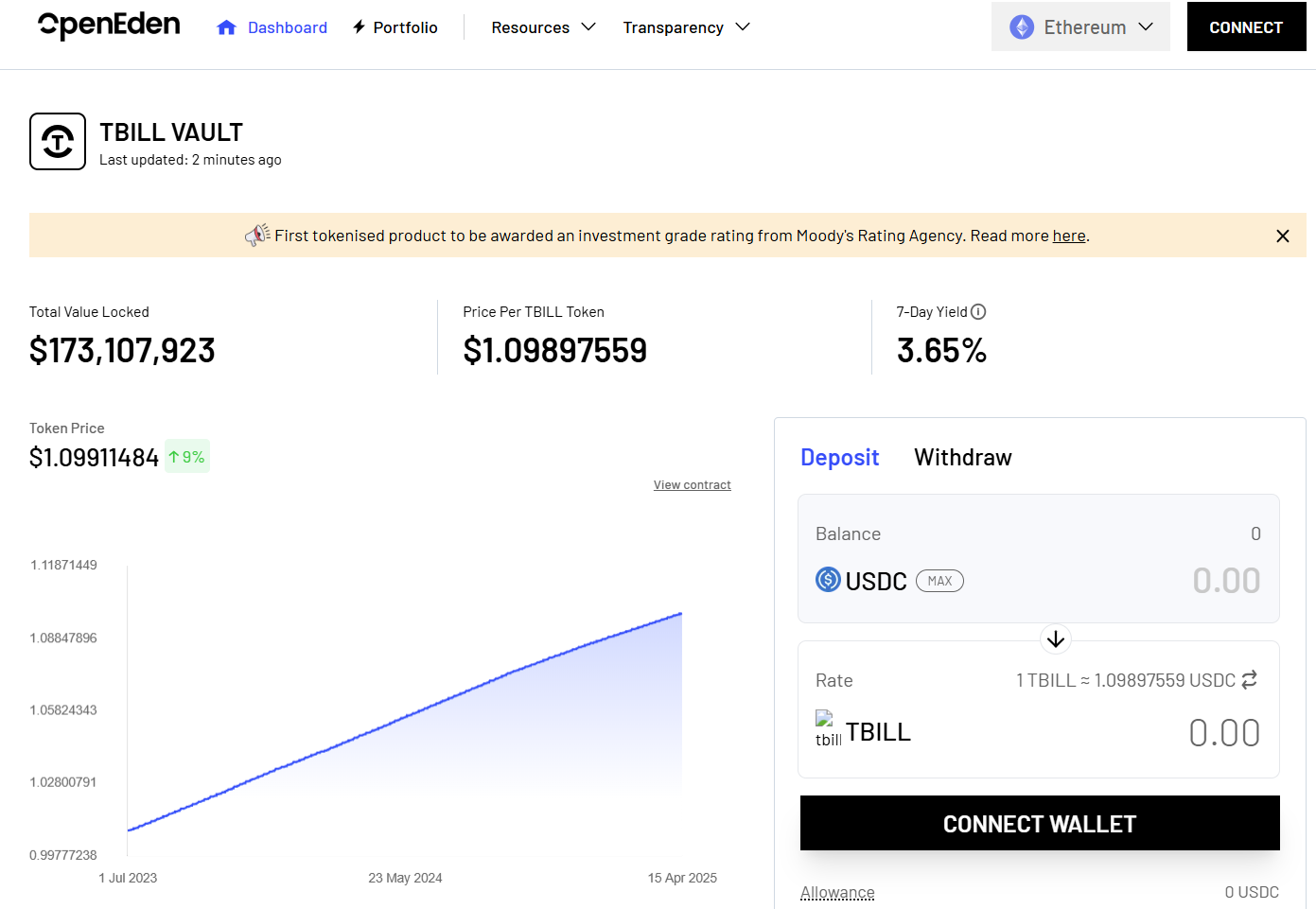

OpenEden is a real-world asset (RWA) DeFi platform with a clear mission – “to unlock trillions by bringing real-world assets on-chain, seamlessly and securely.” In practice, OpenEden focuses on tokenizing traditional financial instruments (starting with U.S. Treasury bills) and making them accessible in DeFi. The project operates with a regulation-first approach, leveraging licensed entities to ensure trust. By straddling traditional finance and crypto, OpenEden aims to offer the risk-free yields of U.S. Treasuries to the crypto ecosystem in a compliant manner.

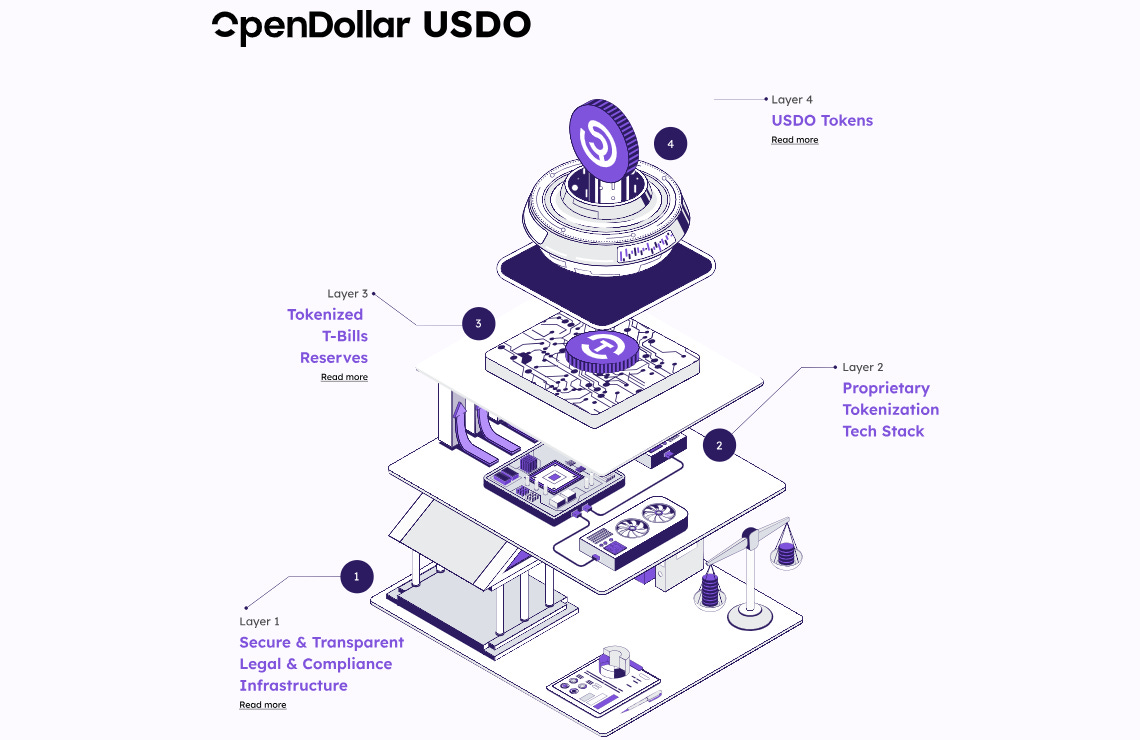

One of OpenEden’s flagship offerings is USDO (OpenDollar) – a stablecoin designed to marry the stability of the U.S. dollar with the yield of U.S. Treasury investments. Launched in 2024, USDO has quickly grown to over $100 million in circulating supply as adoption surged. Amongst the investors, the Arbitrum DAO’s treasury voted to allocate 4 million ARB (~$5M) into OpenEden’s Treasury Bill product, selecting it over 30+ other RWA proposals. Likewise, Ripple’s RWA fund invested $10 million into OpenEden’s T-Bill tokens in 2024. This article provides an in-depth look at OpenEden and USDO, covering its design, real-world asset backing, key partners, governance and adoption in DeFi.

Introduction of USDO, OpenDollar

USDO (OpenDollar) is OpenEden’s U.S. dollar-pegged stablecoin that pays holders the yield of underlying U.S. Treasuries. In practical terms, each USDO is backed by $1 worth of U.S. Treasury bills (and short-term reverse repo agreements) held via OpenEden’s on-chain vault, and it earns the interest those assets generate. USDO employs a rebasing mechanism, the number of USDO tokens in your wallet grows as interest accrues. For users or protocols that prefer a non-rebasing asset, OpenEden also offers cUSDO, a compounding variant, which instead keeps your balance fixed but gradually increases its price above $1 over time.

All USDO tokens are explicitly backed by OpenEden’s TBILL tokens (which represent ownership of T-Bills held by the fund). Only whitelisted, KYC/AML-cleared users can mint USDO by supplying USD. Details are in the Minting Workflow section of the official documentation. USDO is also the main holder of $TBILL: the market cap of $108m USDO is 62% of all the $TBILL outstanding.

RWA Structure and Key Entities Behind USDO

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.