[Serenity Premium] The crvUSD-fFrax Farm and the CRV Valuation [2nd Review Sept 2023]

This article explains the background, source of yield and risks of the crvUSD-fFfrax pool on Curve Finance. Further from here, the valuation of CRV will also be discussed.

Background

On 30 July, Curve Finance was hacked due to a veperlang programming language error. The hack caused massive fear and the CRV price tanked as a result. As collateral damage of the hack, the declining CRV price caused Curve founder, Michael Egorov's borrowings to be on the verge of liquidation. Most of Michael's borrowings are stablecoins, and were collateralised against his CRV holdings.

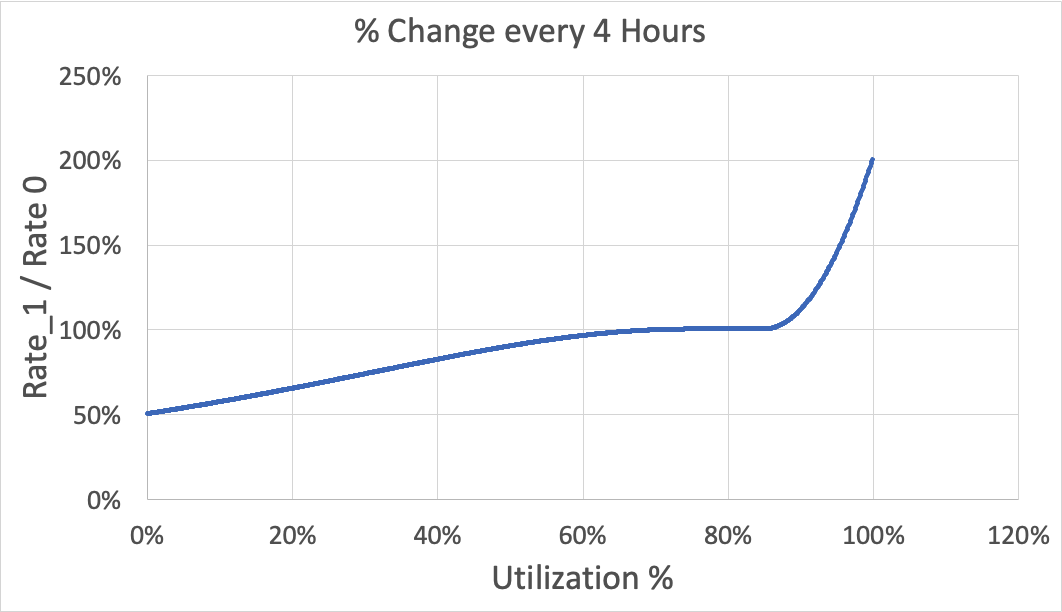

One of Michael's largest borrowings was FRAX borrowed against CRV on Fraxlend by Frax Finance. At that point, Michael borrowed 15.8 million FRAX by collateralising 59 million CRV. Fraxlend has a borrowing penalty when the utilisation of a vault is maxed. Most of the protocols keep the borrowing rate at a slightly higher value when utilisation is high; but Fraxlend makes the borrowing rate accelerate when the utilisation is high, and there's no limit to how high it could be. The graph below from Fraxlend's official documentation suggests that at 100% utilisation the borrowing interest rate doubles every 4 hours.

In several measures to prevent liquidation, Michael created a pool on Curve Finance for crvUSD and Fraxlend's FRAX from the CRV-backed vault, where Michael borrowed a large amount of FRAX. crvUSD is the new LSDfi stablecoin of Curve Finance. fFRAX, or Fraxlend-CRV/Frax, refers to the deposit receipt of FRAX lenders of the CRV-backed FRAX vault on Fraxlend. Michael personally provided incentives for this pool, initially 100,000 in CRV rewards for the first week.

Initially, the 100,000 CRV (roughly $45,000 per week) was a huge incentive for liquidity providers, over than 100% APY for $2m of liquidity. Soon the pool amassed a few million liquidity. This liquidity, which effectively bought into Fraxlend's CRV-backed vault and became a pillar lender of the vault, effectively stopped utilisation to hoover at a high rate. With this pool and other mitigating measures, Michael solved the CRV liquidation crisis in the wake of Curve's hack. Thereafter, Michael has been personally providing CRV incentives on a weekly basis to keep the pool running.

Details of the crvUSD-fFRAX Pool

The pool now has over $10m TVL, with a yield of 10% APY based on Michael's regular weekly CRV incentives. There has been little trading in this pool, so the trading commission is not meaningful compared to incentives. The gauge for this pool (0xd4430498e632f4614c8a83ba4a8cbb3918288800) is up, but there's no CRV emissions directed to this pool so far.

The pool's composition has been largely stable since its launch two months ago. The set up of the factory pool is a V2 pool with standard parameters. Whilst V2 is more for volatile pairs, but it's also popular amongst ETH staking token pairs like cbETH or rETH.

In addition, the yield source of this pool also includes the interest received from FRAX lending. fFRAX, the deposit receive of Fraxlend's CRV vault, is interest bearing like aTokens of Aave. The fFRAX price has grown from 1.067 to 1.080 (see 1st chart below) over the two month period as well. As fFRAX is consistently 60% of the pool, this portion of the yield is also a big part of the yield source. On the other hand, the value of each LP token of this pool is also increasing (see 2nd chart below).

Altogether, the yield of the pool based on today's numbers is: 10.33% + 60% x 9.5% = 16.03%, where 10.33% is the CRV incentive yield and 9.5% is the Fraxlend lender APY.

Having calculated the above, it's worth mentioning that fFRAX will not always hold to its theoretical value against crvUSD, just like stETH and cbETH will have discounts to their fair values from time to time. Our proprietary investment showed that in Sept, our investment APY in this pool was 16.6%, of which 72% of the earnings were CRV rewards and the rest fFRAX appreciation.

The Intrinsic Value of fFRAX

fFRAX's intrinsic value can be calculated as follows :

(a) Total supply: 16.615M

(b) Frax lent out + available: 13.098M + 4.896M = 17.994M

fFRAX intrinsic value (b / a) = 1.083

More information about this token is available at FraxFact.

Currently, fFRAX is trading at a small discount on Curve to its intrinsic value.

Risks of Investing Into crvUSD-fFRAX Pool

Other than the commonly mentioned risks of DeFi, this pool has a few other unique risks. First of all, the CRV rewards for this pool is provided by Michael personally. Michael created and incentivised this pool in order to save his FRAX borrowings from being liquidated. He has an interest to do so, when the CRV price is close to his liquidation price. When CRV price goes up or there's more supply into this Fraxlend vault, he will be less motivated to further incentivise this pool. So far, the crvUSD-fFRAX gauge has not received any veCRV votes to direct weekly CRV emissions to it, as others might not have the motivation to do so.

Secondly, there's also the ultimate risk of Michael's FRAX position being liquidated, when the price of CRV drops significantly or Michael increases his borrowing ratio. Michael's address is public (at least the main one) and we can monitor it. Now he is safe, with over 50% price drop cushion, or approximately $0.25 per CRV, before liquidation threat.

So either the CRV price being too high or too low will have an impact on the risk or yield of this pool.

The Valuation of CRV

The necessary question here is then how much would the reasonable price for CRV be? We have been discussing this for years. First, let's lay some basic numbers:

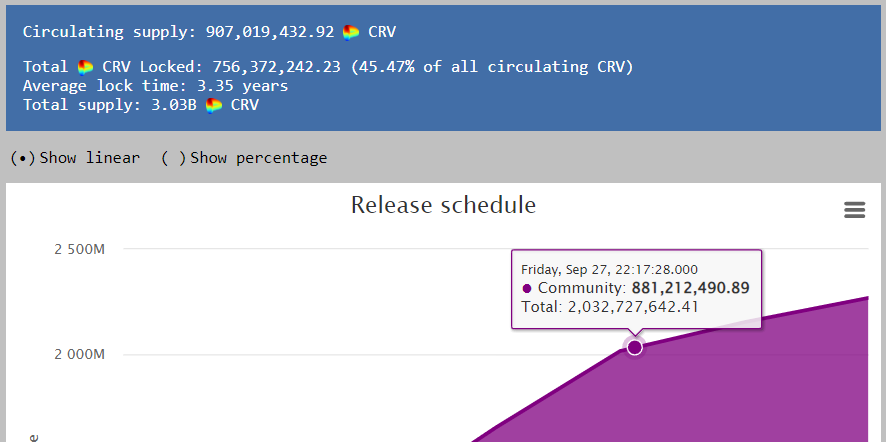

Total circulating supply is 1,663M today, of which 756M is locked into veCRV

In about a year's time, there will be 2,032M CRV in circulation, about 22% inflation

Fees generated by Curve Finance are trading fees of pools, and half of these go to the veCRV holders. In addition, all the interests of borrowing crvUSD go to veCRV holders. Based on Curve Monitor, the last 4 weeks' revenue (fees that go to veCRV holders) is $1.25m, or annualised to be $16.3m.

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.