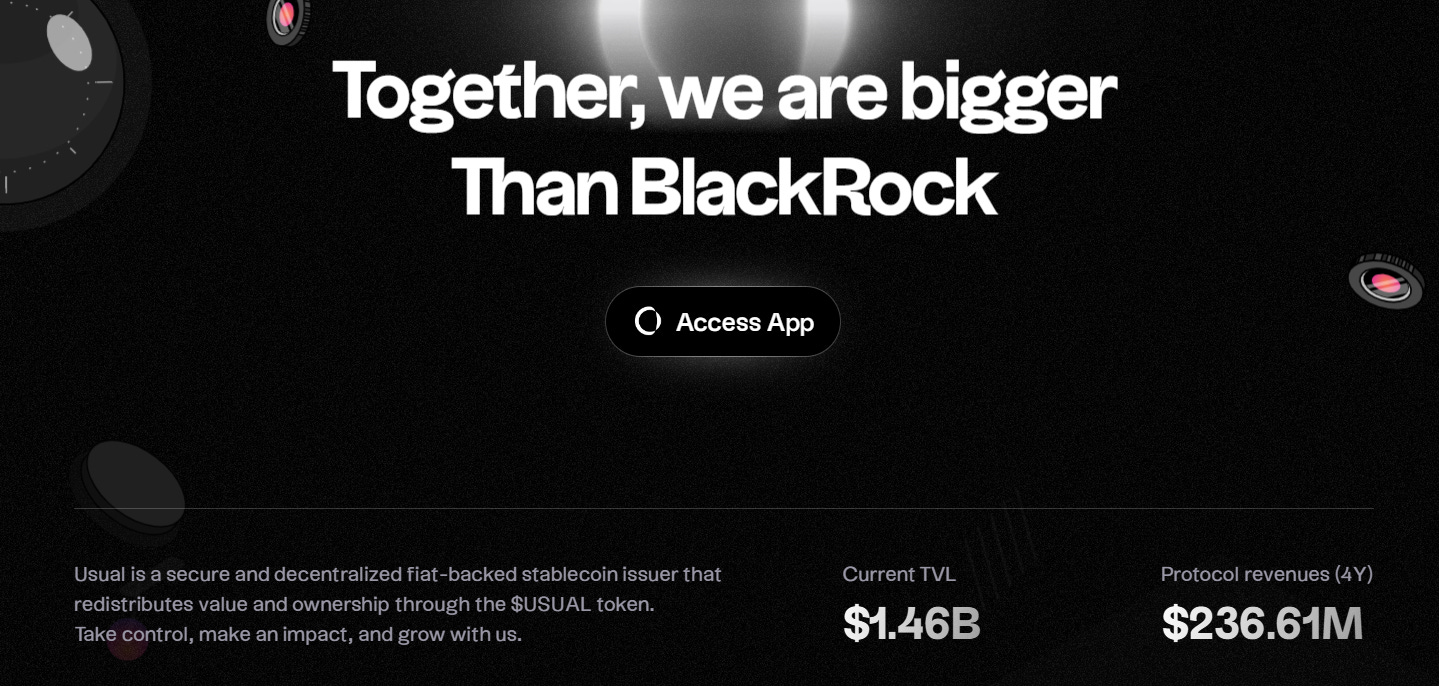

Usual Money's USD0 is undoubtedly the most popular stablecoin this Dec. It has amassed $1.4b stablecoin TVL since its launch in July this year, making it the seventh largest stablecoin and is still growing. The high yield of USD0 is the centre of debate: is this the next Luna or is this a new DeFi innovation? This article discusses our findings on Usual Money and its USD0.

The Basic Concept of Usual and USD0

The basics of Usual and USD0 are rather simple. Usual receives USDC and invests into a portfolio of interest-bearing stablecoin tokens, such as Hashnote's USYC. Therefore, Usual as a protocol, is revenue generating. In return, Usual issues to depositors a stablecoin, USD0, each of which corresponds to 1 dollar it receives. USD0 can be staked into USD0++ to receive the underlying yields from underlying assets, as well as protocol incentives in the form of USUAL tokens. Currently, the yield stands at 77%.

Usual also launches a governance token, USUAL, which apart from any governance utilises, are used as incentives to USD0++ and other initiatives such as providing liquidity for USD0. USUAL, when staked into USUALx, will have a share of protocol revenue, have a share of protocol emission, and receive quitting user penalties.

Usual's Design Simplified

Keep reading with a 7-day free trial

Subscribe to Serenity Research to keep reading this post and get 7 days of free access to the full post archives.