[Serenity] Weekly Stablecoin Alpha - 10 Aug 2023: Some Changes

[As modified from time to time, as a guide to read our Weekly. Our weekly covers stablecoin and ETH delta neutral strategies and service the purpose of calculating an average rate of an investor can get for that week. For alpha hunting, subscribe to our Premium version of this Substack.] [Last update: 28 Mar 2025]

Risk Free Rate

The weighted average of 7 day average Compound V3 and Aave V3 USDC lending rate. ETH market includes Spark.

Mainstream Rate

Most basic strategies on Curve, Uniswap or special protocol’s like Sky (SSR) at this moment.

Benchmark

Pools with more than a sizable TVL (typically more than $4m for stablecoins and 3k ETH for ETH delta neutral) and reasonably safe.

Benchmark is our core research focus. First, this allows users to invest a portfolio of $1m, allocated in several pools, and achieve the Benchmark yield with risks reasonably diversified.

Second and more importantly, users can compare the risk exposures of a protocol/pool/portfolio with the Benchmark pools, to assess if the yield is reasonable. We believe that the DeFi sector is a near efficient market and risk and returns are correlated.

For each pool, we make arbitrary adjustments to its yield, based on our subjective risk assessment.

Exotic Strategies

Pools with some TVL (typically more than $1m for stablecoins and 1k ETH for ETH delta neutral) and market recognition, or it's new, or it has a complex design, or its design feature includes risk of principal loss.

Similarly, this allows a user to diversify a portfolio of a few hundred thousand dollars into several pools and achieve higher yield, whilst taking higher risks. In our Premium version of the Substack, we also provide discussions about these pools and strategies.

For each pool, we make arbitrary adjustments to its yield, based on our subjective risk assessment.

Delta Neutral Strategies

We see this section is a supplement to the above passive strategies under Benchmark and Exotic sections. Since 2024, this has become popular.

This sector include popular perpetual protocol counter party pools (such as GMX’s GLP, Hyperliquid’s HLP) and basis trading protocols (such as Resolv’s USR and RLP).

Funding Rates

Binance and GMX coin-margined futures for large caps.

A typical strategy here is buy coin X, deposit into Binance coin-margined futures and short the same amount to harvest the funding rates.

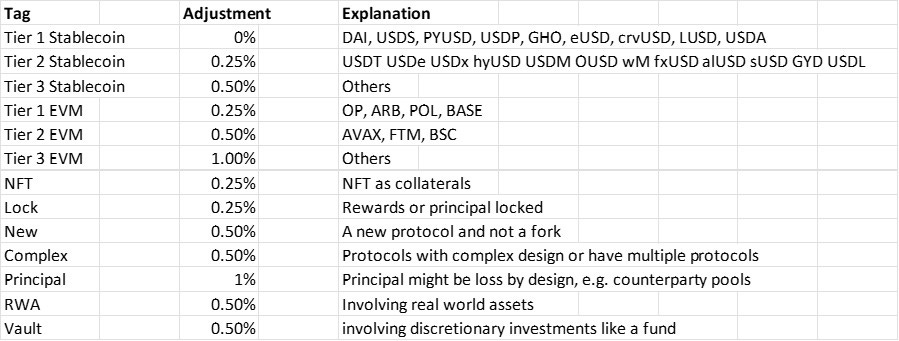

Risk Adjustment

The assessment of risk is subject and anyone can modify these parameters based on his own opinions. The list of stablecoin and ETH derivatives tiering will change from time to time.

[Original Weekly Letter]

This week's article might be a bit longer than usual, as we made some changes to the content structure. In particular, we have combined our Medium publication with Substack now. We have worked on the Medium weekly review of stablecoin yields for three years and now we have improved it to be more relevant. We aim to provide a comprehensive overview of the stablecoin industry, as well as hunting for alphas like other degens. This article explains the Medium overview table's structure and methodology, which we will not repeat in future editions, but you can always refer back to this article in the future.

Featured High Yield Pools

Selection criteria: TVL over 50k

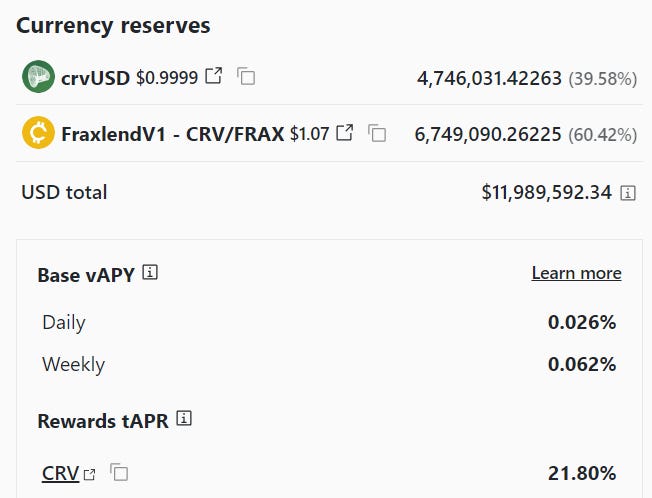

24% and $11m TVL

Full story on our Twitter. This is the Michael Egorvo pool created during the crisis of his potential CRV liquidation. crvUSD is the Curve stablecoin, and FraxlendV1 is the FRAX lending receipts from lending FRAX into the Fraxlend's CRV vault.

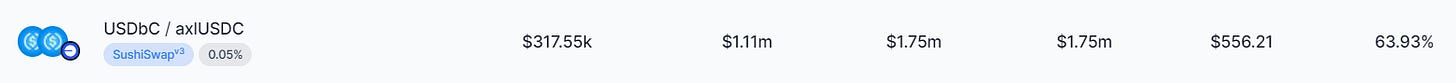

Sushi axlUSDC USDbC on Basechain

63% and $0.3m TVL

Basechain is very hot now but also full of risk. Sushi is at least more reliable. This pool is basically the Axelar bridged USDC and official bridged USDC - the yield would be lasting as TVL on Basechain grows.

Convex cEUR/agEUR/EUROC, 31% and $0.5m TVL, Carry over from last week, see last week's report for details.

Wombex Hay, 22% and $0.2m TVL. The BSC native stablecoin mostly collateralised by BNB derivatives. The pool is a Wombat pool that contains Hay, Frax, cUSD by coin98, and very little Overnight USD+, USDT+ and USDC.

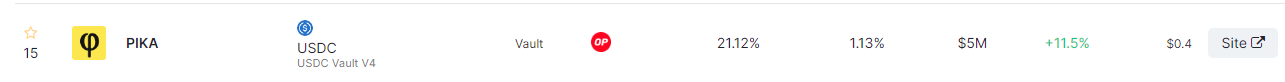

Pika USDC, 28% and $5m TVL. Pike's counterparty vault. The yield includes an 6% trading fee and the rest are esPIKE rewards, which only unlocks over a year.

Other Pools from Defillama Yield

Retro Cash/USDC, 45% and $0.8m TVL. Cash is a Polygon rebase stablecoin by Retro Finance. This is a dynamically managed pool by Gamma and you can claim rewards via Merkl.

Stablecoin Yield Overview

Updated this Monday but will subsequently update every Thursday.

In-Depth Thread or Article Summary

Yes, Paypal has entered the stablecoin market. Apparently Paypal has been planning for some time and it went live this week. There is too much speculation and we suggest waiting to see what's going to happen.

MakerDAO raised its saving rate on DAI to 8% and spurred the growth DAI in a few days.

Frax Finance is proposing under its V3 to incorporate entities to purchase T-bills to back up FRAX.

USDT depegged up to 0.2% over last weekend and concerns about its reserve were again raised.

Disclaimer

The information provided on this document and the referenced sources do not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the content as such. The author of the document makes no representation or warranty as to the accuracy and or timelines of the information contained herein. A qualified professional should be consulted before making any financial decisions.