[Serenity] Weekly Stablecoin Alpha - 1 Dec 2023

Our weekly now covers the alpha in the stablecoin industry and an overview of the investment yields in the industry. For details on how to read the Stablecoin Yield Overview, please refer to this article.

Featured High Yield Pools

Selection criteria: TVL over 50k

68% and $3.8m TVL

Abracadabra, the issuer of MIM, is one of the oldest stablecoins in DeFi. MIM carries bad debt, but smaller than the Treasury - so technically remains fully collateralised. With its STIP, the yield is juicy now.

43% and $4.2m TVL

Thanks to Curve or Michael, the rewards for Pendle Finance's Silo crvUSD pool (collateralised by CRV for borrowing crvUSD in Silo Finance) is amazing. Leverage it further with Magpie to get over 40%.

33% and $2.2m TVL

$USDV by Verified USD Foundation is a RWA stablecoin using the treasury-bill token STBT by MatrixPort as underlying.

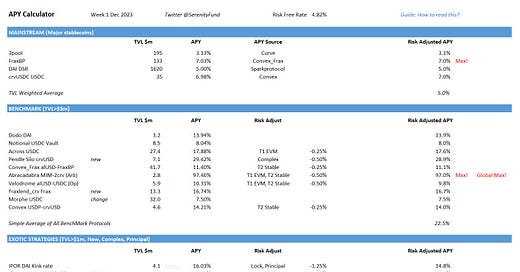

Stablecoin Yield Overview

For the definition details of each category, please refer to our article.

In-Depth Thread or Article Summary

A deep diving into Curve's price oracles

@danielvf made a long and very technical thread on Cruve's price oracle.

Taking a look into Justin Sun' USDD

@RhoRider made a thread questioning the peg of USDD.

Stablecoin TUSD Slightly Depegged Due to Links to Terrorism

The stablecoin TUSD has been slightly depegged, with the lowest price on Binance being 0.9955. Today Reuters reported that the Tron blockchain is used more for terrorism than Bitcoin, and Justin Sun responded.

On-chain liquidity continues to improve, analysts saw more stablecoins minted

@WClementeIII noticed that stablecoin supplies are up another $2.2 billion since -- Now up 2.8% over the last 90 days.

Binance officially removed stablecoin BUSD

Binance has announced that it will officially stop supporting BUSD from December 15. This comes after publisher Paxos was forced to stop issuing and end its relationship with Binance.

A Digest on the Aave DAO's Efforts to Restore $GHO Peg

A novel campaign to raise Aave’s de-pegged stablecoin, GHO, to $1 made significant progress over the past week, but was poised to fall short of an “ambitious” goal just hours before its midnight deadline.

Circle, SBI Holdings focus combined efforts on USDC growth in Japanese market

Stablecoin issuer Circle signed a Memorandum of Understanding (MoU) with Japanese financial giant SBI Holdings to boost USD Coin (USDC) circulation, establish a banking relationship, and expand its presence in the Asian country, according to a Nov. 27 statement.

Paxos receives in-principle approval to issue stablecoins in Abu Dhabi

The approval followed a similar move by regulators in Singapore, where Paxos said its local entity would launch a U.S. dollar-backed stablecoin.

Serenity Team

1 Dec 2023

Disclaimer

The information provided on this document and the referenced sources do not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the content as such. The author of the document makes no representation or warranty as to the accuracy and or timelines of the information contained herein. A qualified professional should be consulted before making any financial decisions.