[Serenity] Weekly Stablecoin Alpha - 22 Sept 2024

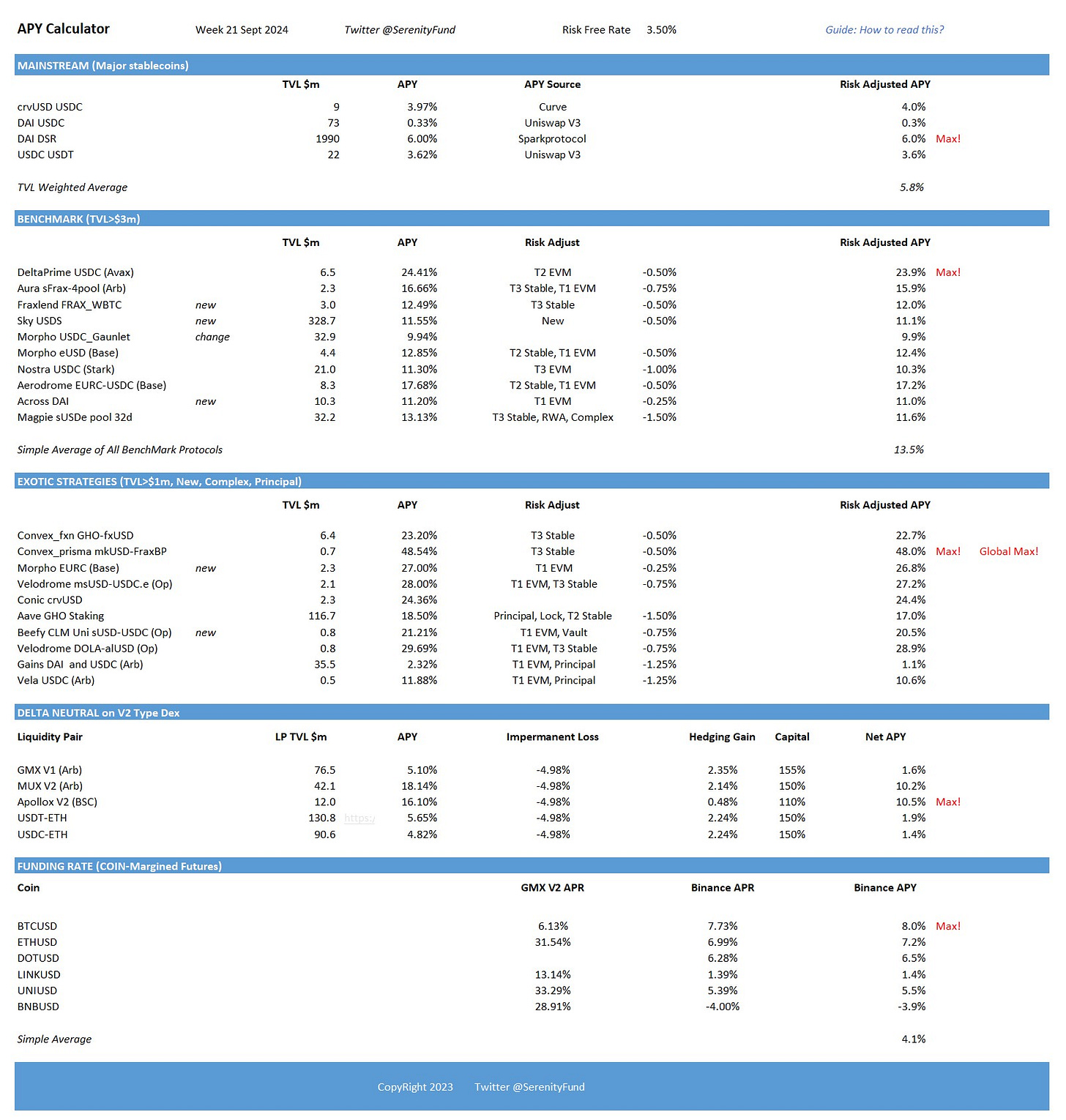

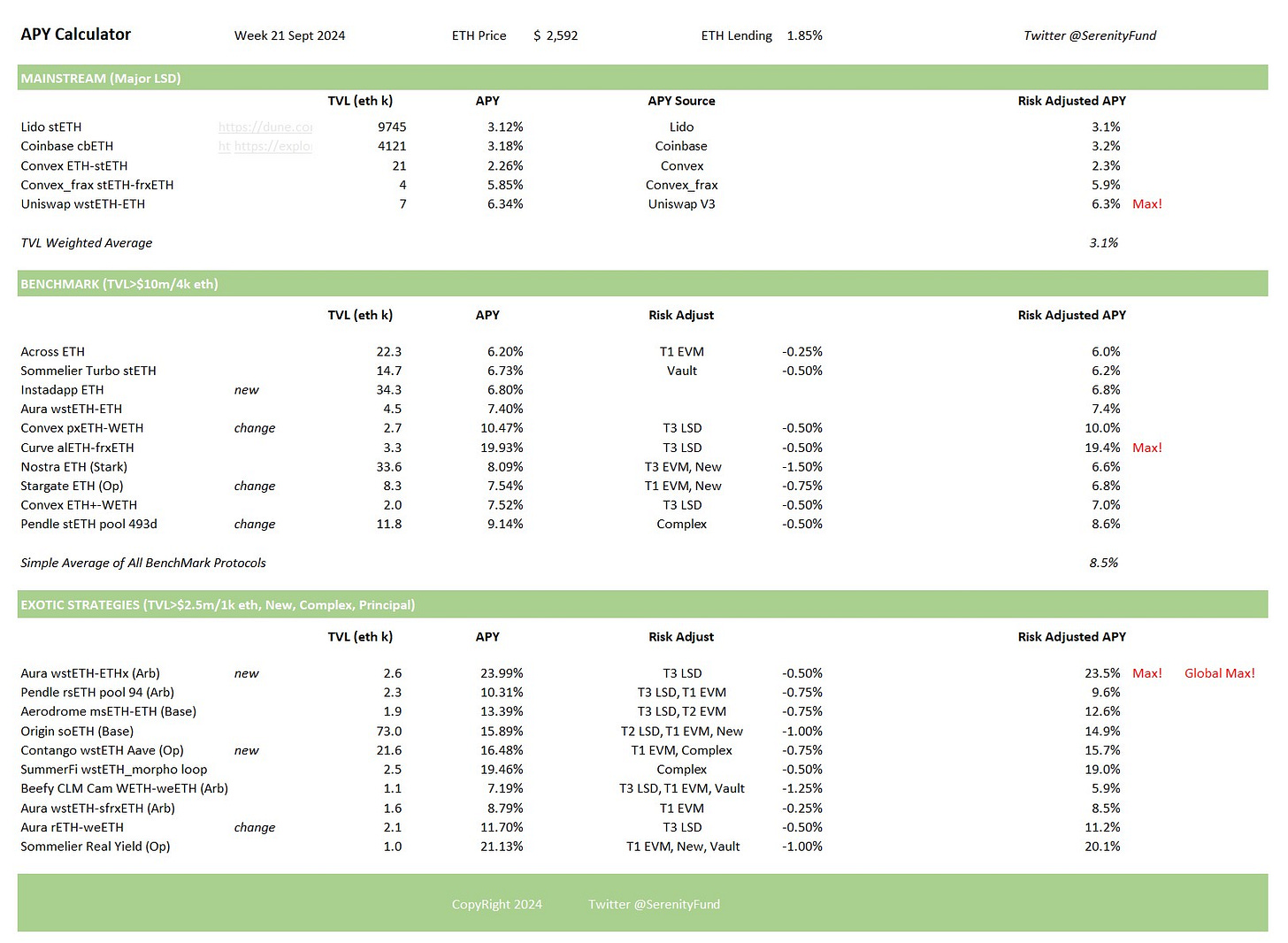

Stablecoin Yield Overview

For the definition details of each category, please refer to our article.

We have also added a delta neutral ETH-denominated yield summary (green table), to be released officially soon.

From June 2024 onwards, the two sections below Featured High Yield Pools and In-Depth Thread or Article Summary are only open to our Premium readers. In particular, the Featured High Yield Pools section introduces niche stablecoin/delta neutral opportunities with yields usually higher than the above tables, but still within our risk scope.

Featured High Yield Pools

Selection criteria: TVL over 50k

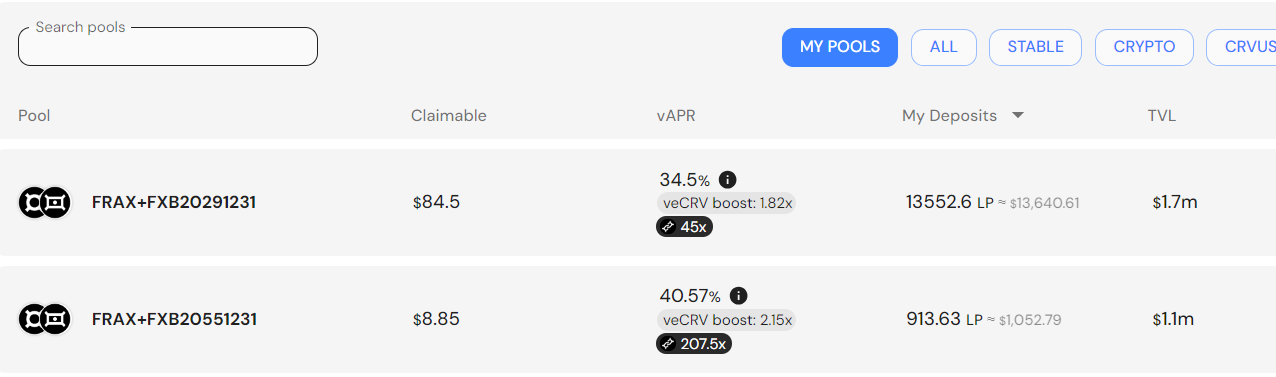

Staying put in Fraxtal FBX bonds, and AUM is now $16,300, surpassing the historical high in August of 16,000 (before the dump of FXB tokens). Now yield is steady and is near 34% for over a week; TVL has improved significantly over the last month.

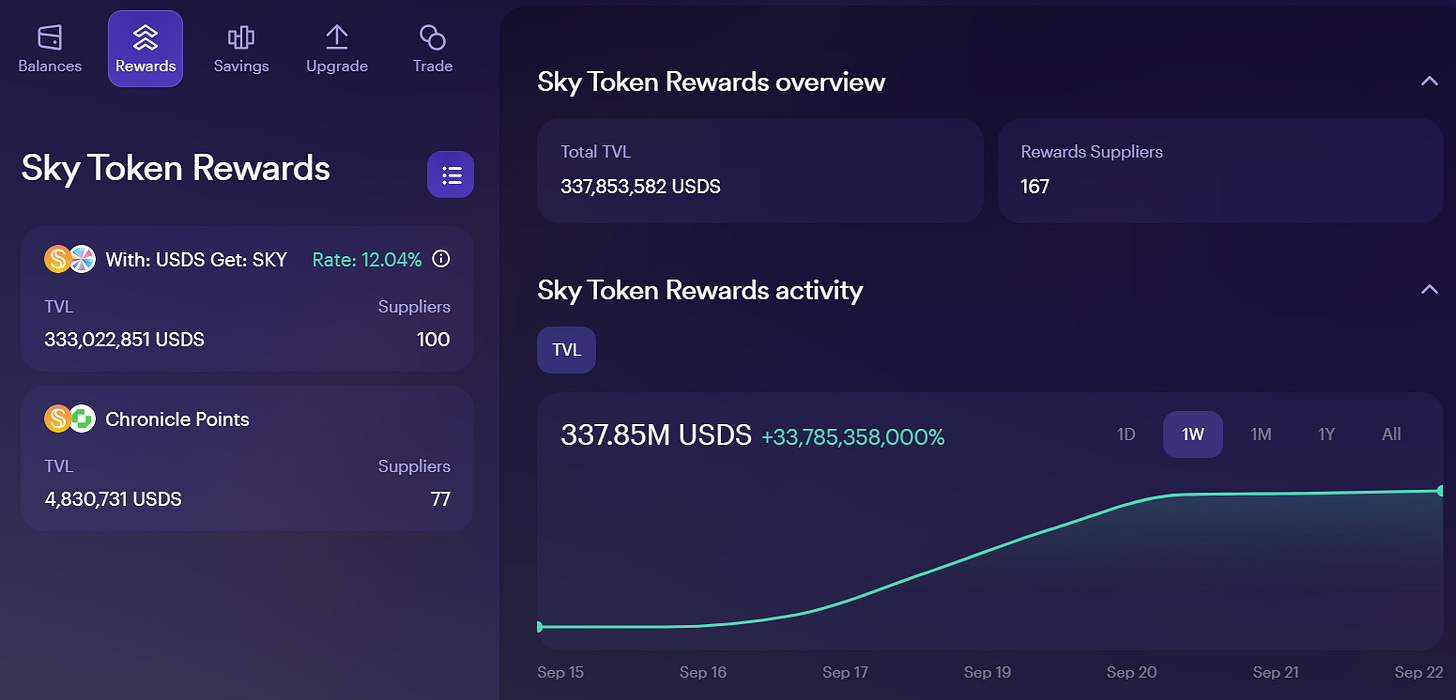

12% and $333m TVL

MakerDao has rebranded to Sky and now there are 333m DAI converted to USDS and farming $SKY rewards. At this scale, the yield is still double digit. Currently, $SKY is swappable to $USDS on Uniswap, but there's no liquidity pool for $USDS yet.

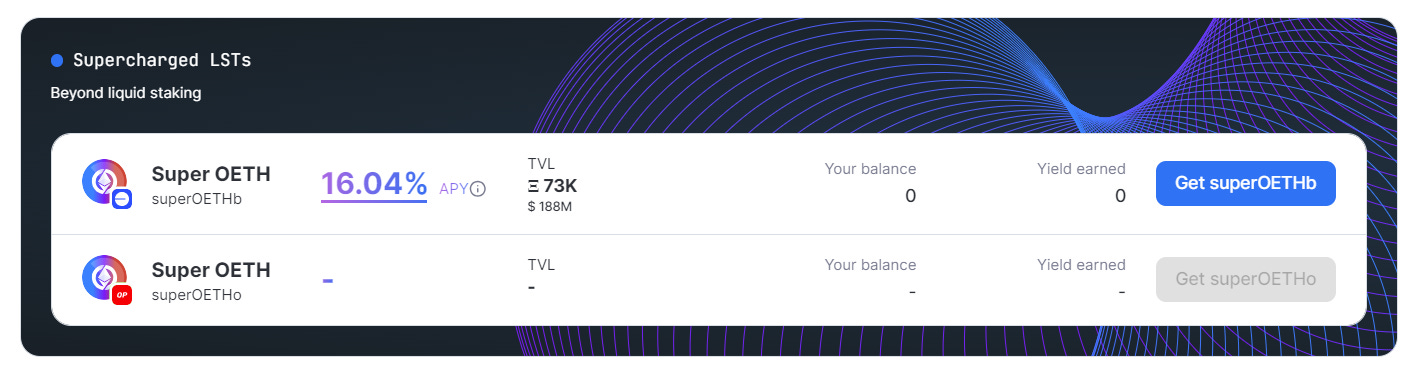

16.4% and $188m TVL

Origin, the issuer of oETH, has launched an enhanced version of staked ETH, soETH, or Super oETH. Super oETH is staking ETH plus a native liquidity pool of soETH-ETH (CL) on Aerodrome, and therefore the yield is also higher.

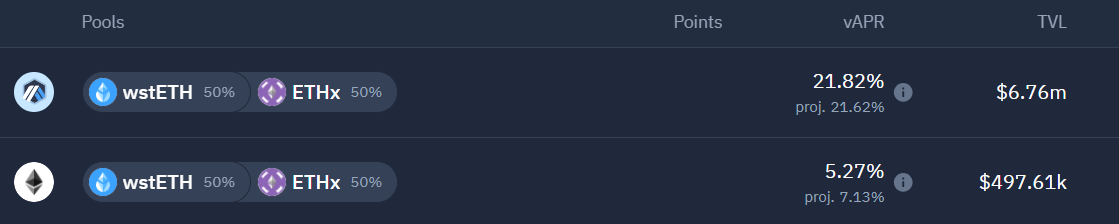

22% and $6.7m TVL

ETHx is Stader Labs' staked ETH, one of the oldest ETH staking service providers. On Arbitrum, the yield came back after one week's break.

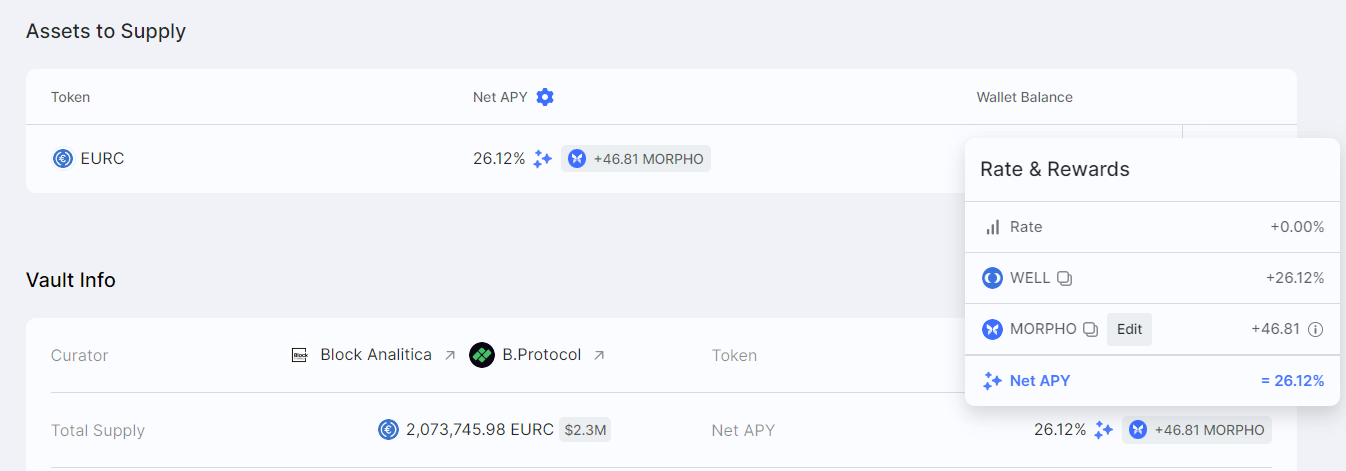

26% and $2.1m TVL

Morpho (Base) now has an EURC pool, curated by B.Protocol and Block Analitica. The rewards are mostly $WELL incentives from Moonwell. Morpho's incentives will only be available at the end of each epoch of one month - the next one is expected to be end of Sept.

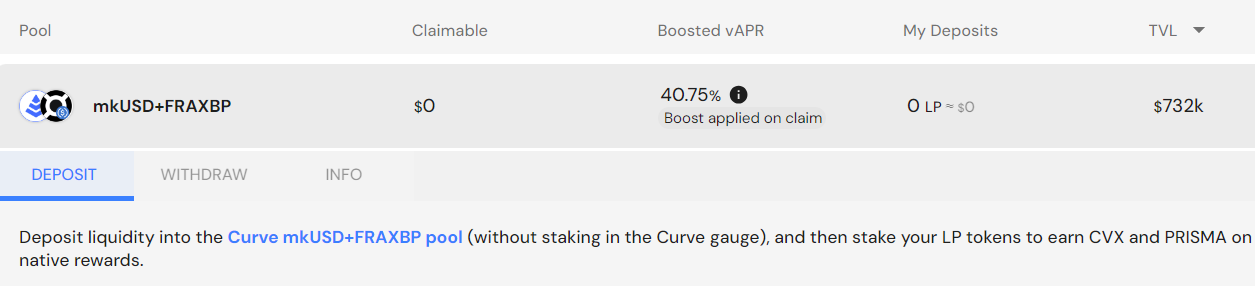

41% and $0.7m TVL

The Prisma team is not very active on their current product now, as they are cooking something new. However, this does not stop the protocol from functioning (and the hack did not make mkUSD depeg, or incur protocol level bad debt). So the yield is impressive, with high but acceptable risk.

In-Depth Thread or Article Summary

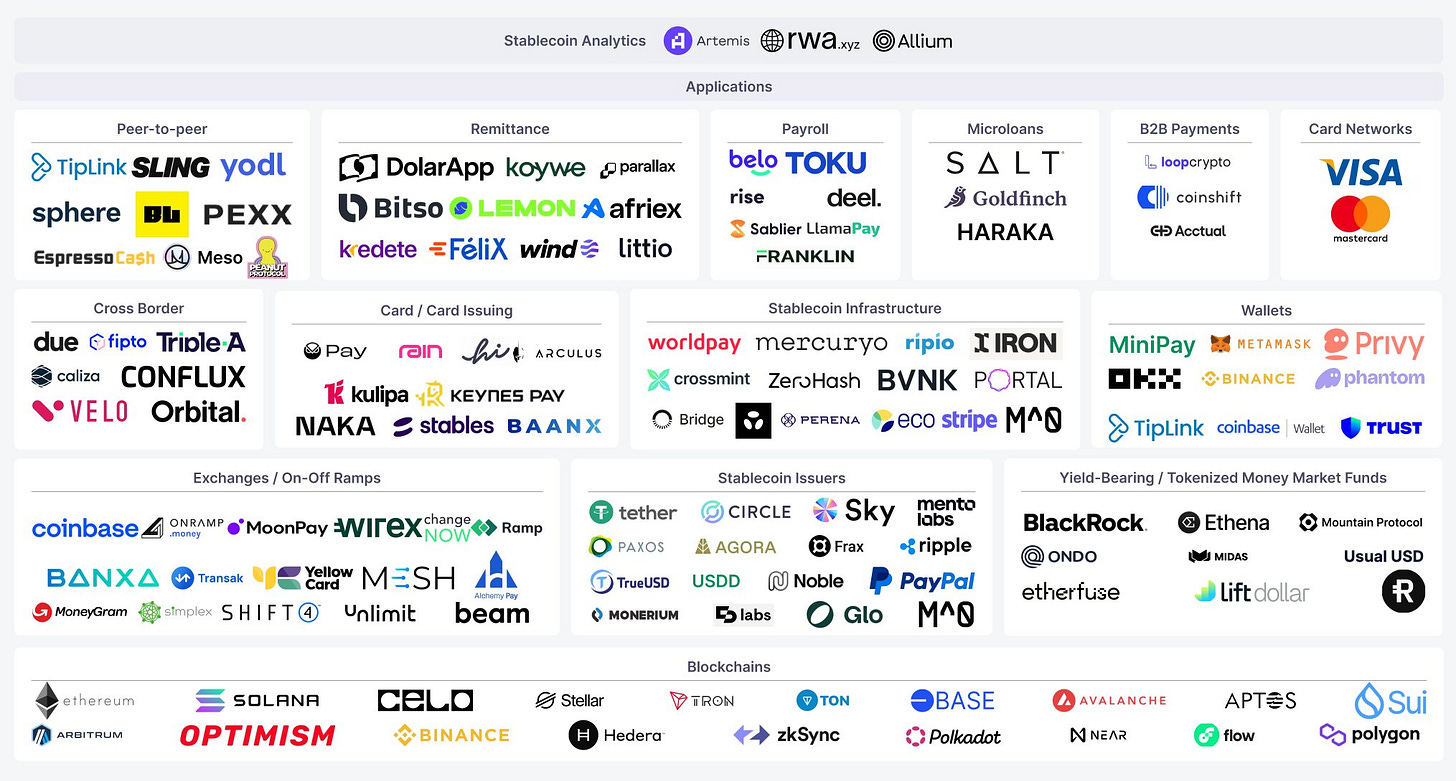

Stablecoin MarketMap by Artemis

Here you go. The map is not comprehensive, but it's a good start.

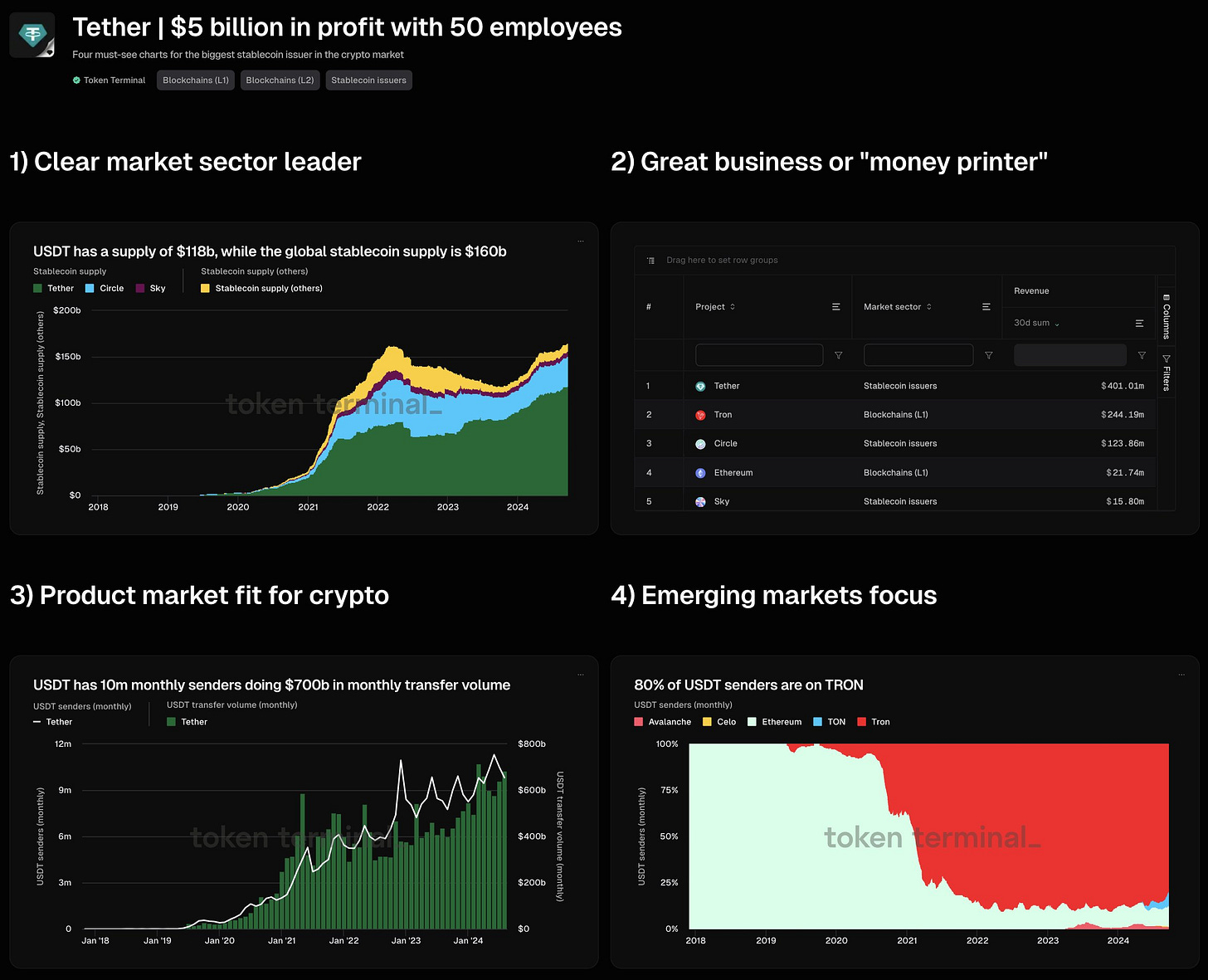

Tether | $5 billion in profit with 50 employees

And the four useful charts on $USDT by @tokenterminal

Ex-Coinbase execs to launch exchange using PayPal stablecoin for settlement

On Sept. 18, True Markets unveiled TrueX, a crypto platform advertised as a “non-custodial, stablecoin-native exchange.” The platform secured $9 million in seed funding from investors like Paxos, Solana Foundation, Aptos, RRE Ventures, Reciprocal Ventures, Accomplice Blockchain and Hack VC.

Goldman Sachs-backed BitGo introduces USDS rewarding stablecoin

On Sept. 18, BitGo officially introduced USDS, a new stablecoin that aims to reward network participants for engaging with the ecosystem by providing liquidity. With the USDS stablecoin, BitGo plans to deploy a novel reward system that would give up to 98% of earnings to participants who support the ecosystem. [Editor: this is a face-off with MakerDAO's launch of $USDS, as MakerDAO claims to ditch Bitgo's WBTC as DAI collateral.]

BNB Chain introduces gasless stablecoin payments initiative

The initiative, revealed on Sept. 18, focuses on making stablecoin payments more accessible, faster, and cheaper, keeping with the chain’s goal of simplifying everyday crypto transactions. Gala Wen, director of ecosystem development at BNB Chain, told Cointelegraph that by partnering with “CEXs, wallet providers, and bridges,” the firm aims to create a “gas-free transaction experience.” [Editor: this is at the moment the business of Tron and the gasless transfers between CEXes will cannibalise Tron's market.]

TON, Curve Finance team up on stablecoin swap initiative

The partnership will collaborate to “incubate a new TON-based stable swap project” to improve user experience and stablecoin trading on the TON blockchain. The TON-based swap project will use Curve Finance’s Constant Function Market Maker (CFMM) technology, known for minimizing the price impact on stablecoin and equivalent asset swaps.

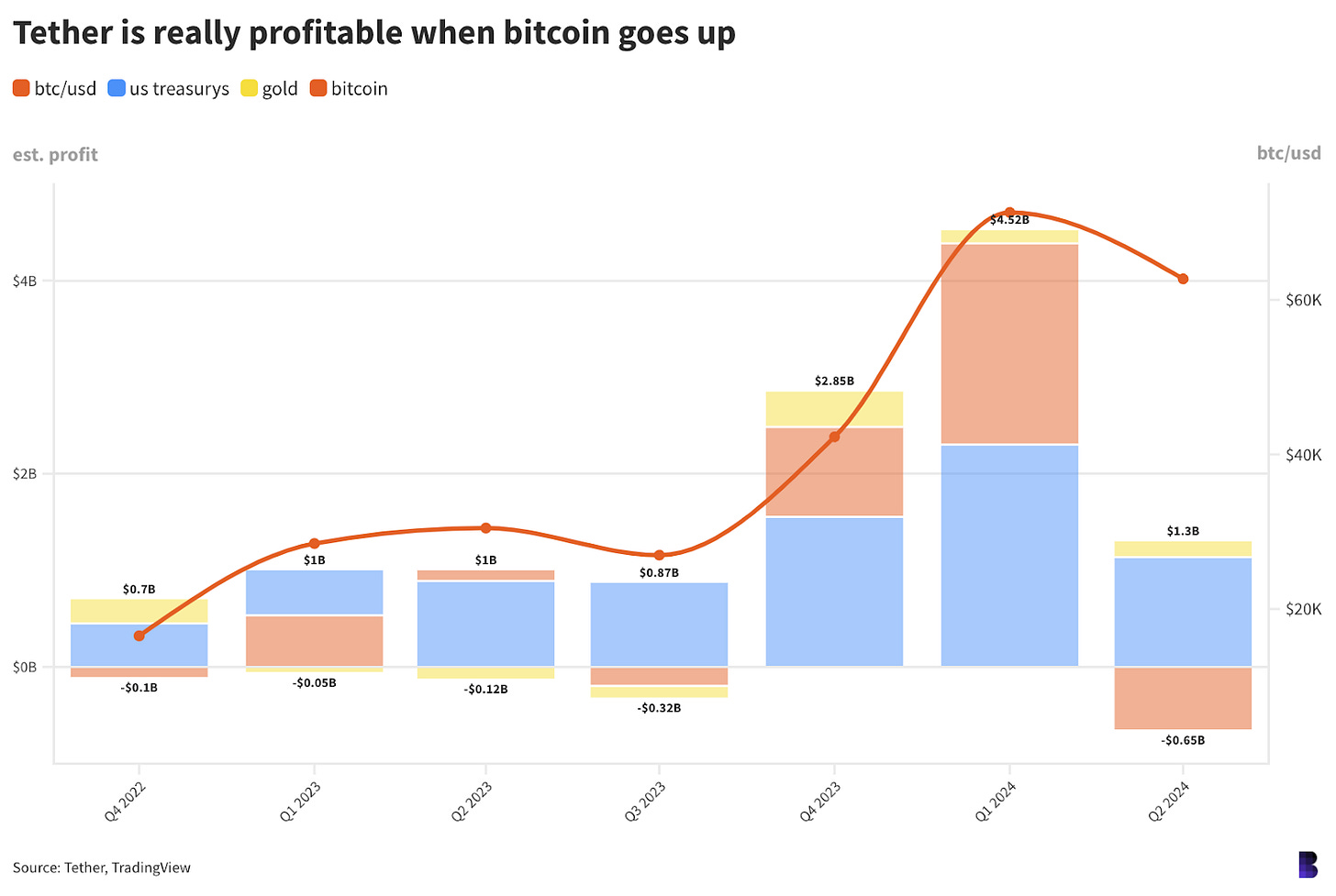

Is Tether really more profitable than BlackRock?

Make no mistake: Tether makes a ton of money. But exactly how much depends a lot on the price of bitcoin. by David Canellis

Serenity Team

22 Sept 2024

Disclaimer

The information provided on this document and the referenced sources do not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the content as such. The author of the document makes no representation or warranty as to the accuracy and or timelines of the information contained herein. A qualified professional should be consulted before making any financial decisions.